In today’s fast-paced financial landscape, accessing personal loans has become a crucial facet of managing life’s unpredictable expenses. The ability to secure funds quickly can offer relief during emergencies or facilitate essential purchases. However, many individuals often encounter hurdles due to stringent documentation requirements, particularly the dreaded salary slip. For those seeking financial support without this prerequisite, the prospect of obtaining a ₹1 lakh loan may seem daunting. This article will explore innovative avenues and alternatives designed to simplify the process of unlocking loans without relying on traditional income proof, making it easier than ever to access the funds you need when you need them most.

Understanding the Basics of No-Salary-Slip Loans

In the realm of personal finance, no-salary-slip loans have gained prominence, especially among individuals who may not have a traditional employment status. These loans provide a viable alternative for freelancers, small business owners, or those receiving income from various non-salaried sources. Here are a few key aspects to consider:

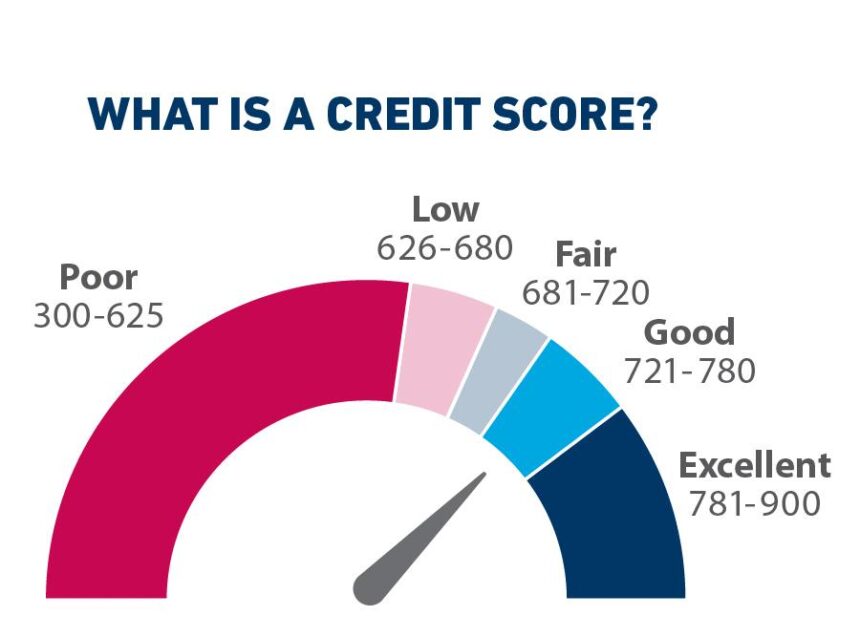

- Eligibility: Unlike traditional loans, lenders often assess the applicant’s overall income, credit score, and repayment capacity instead of strictly requiring a salary slip.

- Documentation: Commonly required documents may include bank statements, income tax returns, or business registration documents, showcasing your financial health.

- Loan Amounts: These loans typically range based on financial evaluation but can offer amounts such as ₹1 Lakh or more, contingent on the lender’s policy.

Understanding the terms and interest rates associated with no-salary-slip loans is crucial. Interest rates may vary significantly from one lender to another, reflecting the risk assessed against the borrower’s profile. To illustrate this, the following table provides a simple comparison of possible terms:

| Loan Provider | Interest Rate (%) | Repayment Tenure (Months) |

|---|---|---|

| Provider A | 12-15 | 12-36 |

| Provider B | 10-14 | 6-24 |

| Provider C | 11-16 | 18-48 |

Navigating Eligibility Criteria and Documentation

When it comes to accessing loans without providing a salary slip, understanding the eligibility criteria is crucial. Lenders typically assess various factors to determine whether you meet their requirements. These may include:

- Age: Applicants usually need to be at least 21 years old.

- Credit Score: A good credit score can significantly improve your chances.

- Income Stability: Proof of alternative income sources, such as business income or rental income.

- Financial History: A clean financial background can play a vital role.

Documentation is equally important in this process. While a salary slip may not be necessary, you will still need to provide specific documents that verify your eligibility. Here’s a brief overview of common documents required:

| Document Type | Description |

|---|---|

| ID Proof | Government-issued ID such as Aadhar Card or Passport. |

| Address Proof | Utility bills or rental agreements. |

| Income Proof | Bank statements or tax returns for the last few months. |

| Application Form | Completed application form with personal and financial details. |

Exploring Alternative Income Sources for Loan Approval

When traditional employment documentation falls short, exploring various income avenues can significantly enhance your chances of obtaining that ₹1 lakh loan. Consider diversifying your income streams through the following options:

- Freelancing: Utilize your skills in writing, graphic design, or web development to earn income without a fixed salary.

- Rental Income: If you own a property, renting it out can provide a substantial and steady cash flow.

- Investments: Income generated from stocks, mutual funds, or dividends can be considered as alternative income.

- Side Hustles: Engage in gig economy jobs such as driving for ride-sharing services or selling crafts online.

Each of these income sources can serve as proof of your financial capability. Here’s a quick overview of how they positively impact your loan application:

| Income Source | Benefits for Loan Approval |

|---|---|

| Freelancing | Demonstrates skill and versatility, can provide a portfolio. |

| Rental Income | Stable cash flow that adds security to your application. |

| Investments | Potential for passive income, showing financial acumen. |

| Side Hustles | Flexibility to earn extra, proving your resourcefulness. |

Tips for Choosing the Right Lender for Your Financial Needs

When looking for the right lender for your financial needs, it’s essential to consider several key factors that can significantly influence your borrowing experience. Start by evaluating the interest rates offered by various lenders. A lower interest rate can lead to substantial savings over the loan’s term. It’s also wise to check for hidden fees, such as processing or prepayment charges, as these can add to the overall cost of the loan. Moreover, assess the lender’s reputation and customer service track record, which can provide insights into their reliability.

Another critical aspect to consider is the flexibility of the loan terms. Look for lenders that allow you to customize repayment schedules that fit your financial situation. Additionally, gathering information on the documents required during the application process can further aid in your decision-making. Many lenders now offer quick online applications, making it easier to secure loans without extensive documentation. Below is a simple comparison table to help outline these considerations:

| Lender | Interest Rate | Hidden Fees | Repayment Flexibility |

|---|---|---|---|

| Lender A | 8.5% | No | Customizable |

| Lender B | 9.0% | Processing Fee | Standard |

| Lender C | 7.8% | No | Flexible |

Concluding Remarks

In conclusion, navigating the world of loans can often feel overwhelming, especially when traditional requirements like salary slips stand in the way. However, understanding the options available to unlock ₹1 Lakh loans without these documents paves the way for greater financial flexibility. With the right information and resources, you can confidently take steps toward securing the funding you need. Whether for unexpected expenses, personal projects, or pursuing dreams, remember that alternative lending solutions exist to empower you. As you embark on this journey, stay informed, assess your options wisely, and always choose the path that aligns best with your financial goals. Here’s to unlocking opportunities and embracing the possibilities ahead!