Understanding Credit Scores for Personal Loans in India

In the bustling financial landscape of India, credit scores play a pivotal role in shaping an individual’s access to personal loans. As the gateway to borrowing money, these numerical values reflect a borrower’s creditworthiness, influencing lenders’ decisions. Understanding how credit scores work can empower potential borrowers to make informed choices, ultimately leading to better financial outcomes. This article unravels the intricacies of credit scores, exploring how they are calculated, their significance in securing personal loans, and the steps individuals can take to improve their scores. Whether you are looking to fund a dream vacation, consolidate debt, or manage unforeseen expenses, a solid grasp of credit scores will equip you with the knowledge to navigate the loan application process with confidence.

Exploring the Components of Credit Scores and Their Impact on Personal Loans

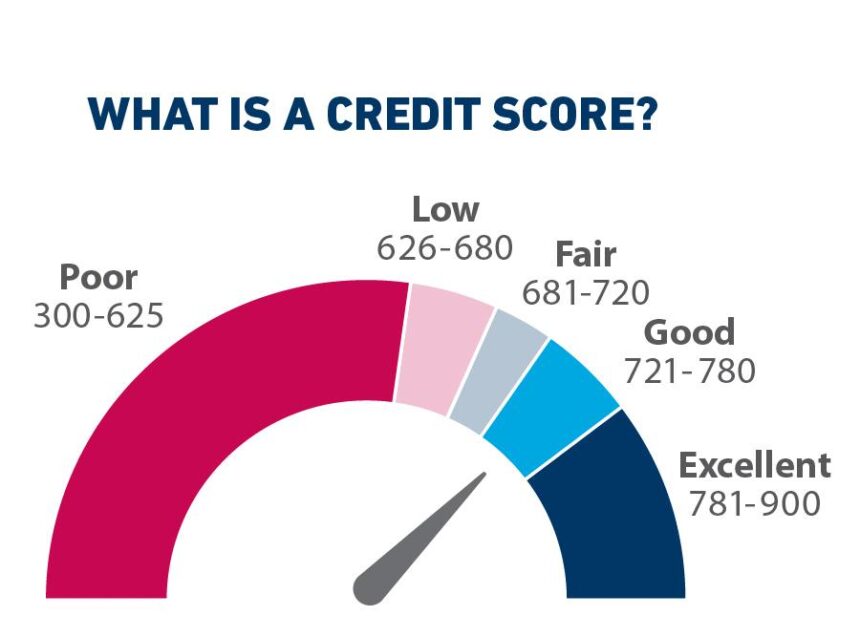

Understanding the components of credit scores is essential for anyone looking to secure a personal loan in India. Credit scores are primarily derived from factors such as payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. A favorable credit score typically ranges between 750 and 900, with borrowers in this range often enjoying better interest rates and loan terms. On the other hand, scores below 650 may lead to higher interest rates or even loan rejections. Thus, maintaining a good credit score is pivotal for financial health and obtaining the best loan conditions.

Additionally, the impact of credit scores on personal loans extends beyond mere approval. Lenders assess these scores to gauge the risk associated with loans. A higher score often translates to lower interest rates, allowing borrowers to save significantly over the loan term. To illustrate, consider the following table showing potential savings based on varying credit scores:

| Credit Score Range | Interest Rate | Loan Amount (INR 10,00,000) | Total Interest Paid (5 years) |

|---|---|---|---|

| 750 – 900 | 8% | 10,00,000 | ₹1,84,123 |

| 650 – 749 | 10% | 10,00,000 | ₹2,36,000 |

| 550 – 649 | 12% | 10,00,000 | ₹2,93,484 |

By understanding these dynamics, individuals can make informed decisions on their financial futures, ensuring they not only secure loans but also manage them effectively.

Decoding the Credit Score System: Key Calculations and What They Mean for You

Understanding your credit score is crucial when it comes to securing personal loans in India. The score typically ranges from 300 to 900, with higher scores indicating better creditworthiness. Significant factors influencing your score include:

- Payment History: Timely repayment of existing loans boosts your score.

- Credit Utilization: Keeping your credit usage below 30% of your total credit limit is advisable.

- Credit Mix: A healthy mix of secured and unsecured loans enhances your profile.

- Length of Credit History: Longer credit histories demonstrate responsible borrowing.

- New Credit Inquiries: Frequent credit checks can negatively impact your score.

To further decode the credit score system, lenders often employ a scoring model which assigns different weights to each factor. For example, payment history typically constitutes about 35% of your score, making it the most critical component. Understanding this distribution can help you prioritize what to improve. Regularly checking your credit report for errors can also play a significant role. Here’s a simplified table representing the weightage of different factors:

| Factor | Weightage (%) |

|---|---|

| Payment History | 35 |

| Credit Utilization | 30 |

| Length of Credit History | 15 |

| New Credit Inquiries | 10 |

| Credit Mix | 10 |

Strategies to Improve Your Credit Score Before Applying for a Personal Loan

Enhancing your credit score is vital before applying for a personal loan. Start by checking your credit report for errors; inaccuracies can significantly impact your score. Make sure to dispute any discrepancies you find with the credit bureau. Timely payments are crucial; aim to pay your bills on or before their due dates. Also, keep your credit utilization ratio low-ideally below 30%-by reducing outstanding balances or increasing your credit limits.

Another effective strategy is to avoid applying for new credit accounts in the months leading up to your loan application. Each inquiry can temporarily lower your score, so it’s wise to limit these. Instead, focus on building a positive credit history by keeping older accounts open and active. If necessary, consider obtaining a secured credit card or becoming an authorized user on someone else’s account to boost your credit profile. Here’s a quick checklist to help you stay on track:

| Action | Status |

|---|---|

| Check credit report | ✅ Complete |

| Dispute errors | ✅ In Progress |

| Pay bills on time | ✅ Ongoing |

| Limit new credit inquiries | ✅ Achieved |

| Maintain low credit utilization | ✅ Monitoring |

Navigating Loan Approval: How a Better Credit Score Can Save You Money

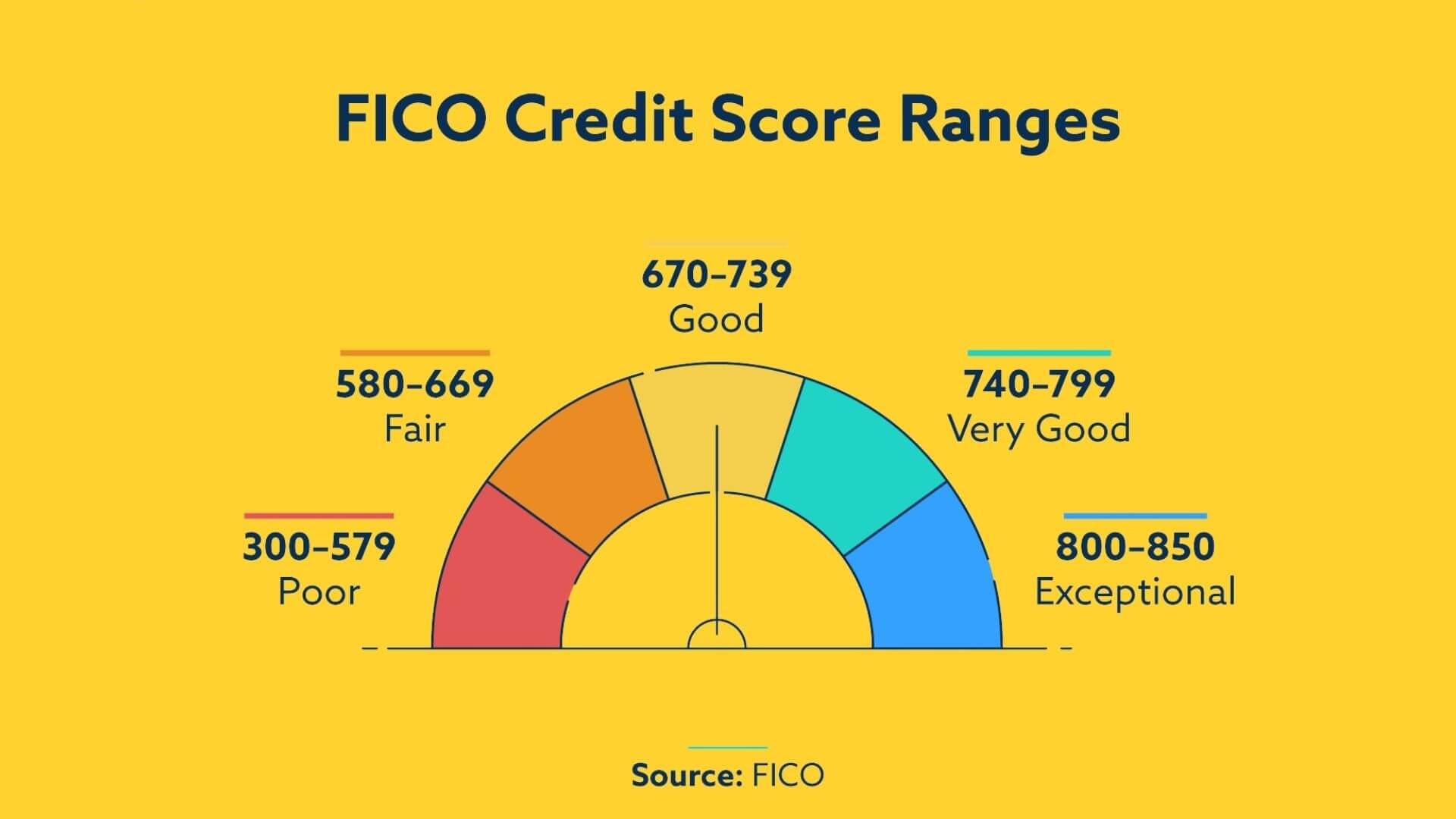

Having a robust credit score can significantly impact your loan approval process and the overall cost of borrowing. A higher score often translates to lower interest rates, which can save you a substantial amount over the life of a loan. For instance, with a good credit score, you might secure a personal loan with interest rates ranging from 10% to 12%, whereas a lower score could lead to rates exceeding 20%. This difference can affect monthly payments and your total financial commitment.

Here are a few key factors that illustrate how a better credit score can save you money:

- Lower Interest Rates: Better scores generally yield more favorable terms.

- Higher Loan Amounts: Lenders are more willing to approve larger loans for reliable borrowers.

- Flexible Repayment Options: Trustworthy borrowers often receive more flexible terms.

| Credit Score Range | Typical Interest Rate | Loan Amount |

|---|---|---|

| 300 – 579 | 20% – 30% | Up to ₹1 Lakh |

| 580 – 669 | 15% – 20% | ₹1 Lakh – ₹5 Lakhs |

| 670 – 739 | 10% – 15% | ₹5 Lakhs – ₹10 Lakhs |

| 740 and above | 7% – 10% | ₹10 Lakhs and above |

In Retrospect

In conclusion, understanding credit scores is crucial for navigating the landscape of personal loans in India. As you embark on this financial journey, remember that your credit score is not merely a number; it’s a reflection of your financial health and responsibility. By maintaining a good credit history, managing debts wisely, and staying informed about your credit status, you can enhance your opportunities for securing favorable loan terms. Whether you’re looking to finance a dream home, invest in education, or manage unexpected expenses, a solid credit score can unlock the doors to financial possibilities. Stay proactive, monitor your credit regularly, and make informed decisions to pave the way for a brighter financial future.