In the complex maze of modern banking, countless consumers find themselves ensnared by hidden fees that stealthily chip away at their hard-earned money. From monthly maintenance charges to seemingly innocuous ATM withdrawal fees, these financial landmines can catch even the savviest of users off guard. As Americans strive for financial wellness, understanding the ins and outs of these sneaky charges becomes crucial. This article seeks to illuminate the strategies that can help you navigate bank policies, ensuring that you keep more of your money where it belongs-in your pocket. Let’s delve into the secrets of outsmarting banking fees and reclaim your financial freedom.

Understanding Common Bank Fees and How They Catch You Off Guard

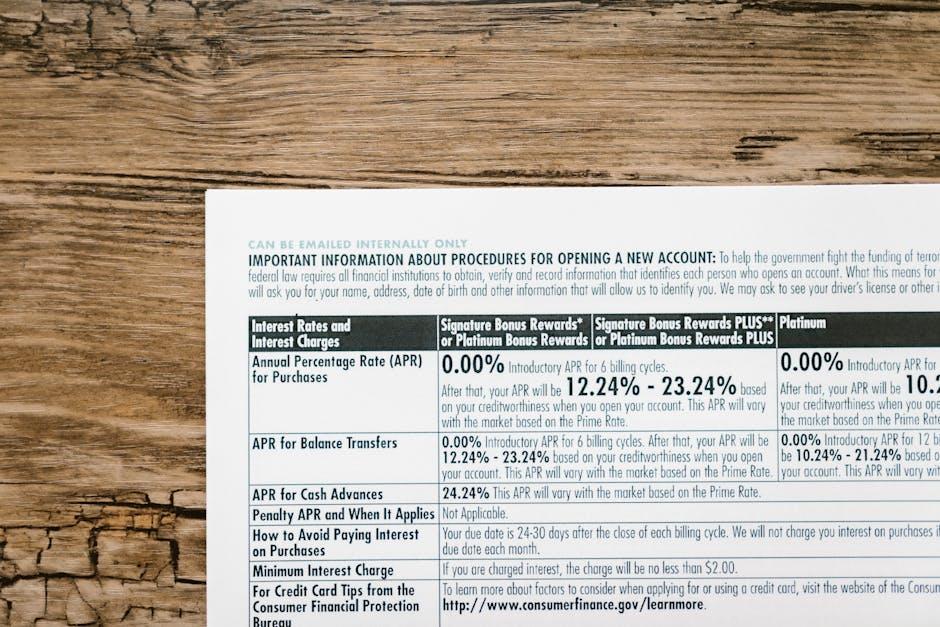

Bank fees can often feel like hidden traps that catch you off guard, especially when you’re least expecting them. Understanding these fees is essential to managing your finances effectively and avoiding unnecessary charges. Here’s a breakdown of the most common fees that American banks typically charge:

- Monthly Maintenance Fees: Many banks impose a monthly fee to keep your account active. These can range anywhere from $5 to $15, depending on the account type.

- Overdraft Fees: If you spend more than what you have in your checking account, you could be charged an overdraft fee, often around $35 per transaction.

- ATM Fees: Using an ATM outside of your bank’s network can incur fees, both from your bank and the third-party ATM provider. This could add up to $5 or more per transaction.

- Wire Transfer Fees: Sending or receiving money through wire transfer may cost you between $15 and $50, depending on whether the transfer is domestic or international.

- Paper Statement Fees: Some banks charge for providing paper statements, usually around $2 per month, encouraging you to opt for electronic statements instead.

- Account Closure Fees: If you close your account shortly after opening it, there may be a fee. This is often around $25, meant to discourage account churn.

| Fee Type | Typical Amount | How to Avoid |

|---|---|---|

| Monthly Maintenance Fee | $5 – $15 | Maintain a minimum balance or set up direct deposits. |

| Overdraft Fee | $30 – $35 | Link a savings account for overdraft protection. |

| ATM Fee | $5+ | Use in-network ATMs or cashback options at retailers. |

| Wire Transfer Fee | $15 – $50 | Use free online alternatives like Zelle. |

| Paper Statement Fee | $2 | Opt for electronic statements. |

| Account Closure Fee | $25 | Keep your account open for a certain period. |

By being aware of these charges and how they can accumulate, you can take proactive steps to avoid them. Always read your account agreements carefully and don’t hesitate to ask your bank about any fees you don’t understand. Knowledge is your best tool in managing your finances wisely!

Navigating Account Terms to Avoid Surprise Charges

When it comes to managing your bank account, understanding the terms and conditions is crucial to avoid unexpected fees. Here are some key areas to watch out for, along with practical tips to navigate them effectively:

- Monthly Maintenance Fees: Many banks charge these fees, usually ranging from $5 to $20. To avoid them, consider choosing accounts that waive fees based on maintaining a minimum balance or setting up direct deposit.

- Overdraft and Non-Sufficient Funds Fees: These can add up quickly, averaging $30 to $35 per occurrence. To sidestep these charges, keep track of your account balance and consider opting for overdraft protection, which may involve a fee but is typically less than the overdraft fee itself.

- ATM Fees: Using ATMs outside your bank’s network can incur charges of $2 to $3. To minimize these costs, look for banks with extensive ATM networks or accounts that refund out-of-network ATM fees.

- Inactivity Fees: If your account remains inactive for a specified period, usually six months to a year, you might face inactivity fees ranging from $5 to $20 monthly. Regularly check account activity, and consider scheduling small transactions to keep your account active.

| Fee Type | Average Cost | How to Avoid |

|---|---|---|

| Monthly Maintenance Fee | $5 to $20 | Maintain minimum balance or direct deposit |

| Overdraft Fee | $30 to $35 | Track balances and consider overdraft protection |

| ATM Withdrawal Fee | $2 to $3 | Use in-network ATMs or accounts with fee refunds |

| Inactivity Fee | $5 to $20/month | Keep the account active with regular transactions |

Additionally, always read the fine print before opening an account or changing terms. Awareness of your bank’s policies on wire transfers, foreign transaction fees, and other service charges can save you from unpleasant surprises. Being proactive in managing your account can lead to significant savings over time!

Smart Strategies for Choosing the Right Banking Products

When selecting banking products, it’s essential to make informed choices to minimize fees and maximize benefits. Here are some smart strategies that can guide you in navigating the landscape of American banks:

- Research Your Options: Compare various banks and credit unions. Look for institutions that offer no-fee checking accounts or accounts with low minimum balance requirements.

- Understand Fees: Take the time to read the fine print. Be aware of monthly maintenance fees, ATM fees, overdraft fees, and foreign transaction fees.

- Utilize Online Tools: Many financial websites and apps allow you to compare products side-by-side. Use these tools to find the best deal tailored to your needs.

- Choose the Right Account Type: Depending on your financial habits, a high-yield savings account or a no-fee checking account could suit you better than a traditional bank account.

- Consider Direct Deposit: Some banks waive monthly fees if you set up direct deposit. This can be a simple way to save money without extra effort.

- Leverage Online Banks: Online banks often offer higher interest rates and fewer fees compared to brick-and-mortar banks. Consider making the switch if you don’t need in-person services.

- Check for Promotions: Keep an eye out for bonuses or promotional offers from banks that reward you for opening an account, which can offset any initial fees.

- Maintain Your Balance: If your account charges fees based on minimum balances, make sure to keep your balance above the required threshold to avoid penalties.

| Bank Type | Pros | Cons |

|---|---|---|

| Traditional Banks | Access to ATMs and branches, varied services | Higher fees, lower interest rates |

| Online Banks | High interest rates, low fees | No physical branches, limited service hours |

| Credit Unions | Member-focused service, low fees | Limited access to branches, membership requirements |

By implementing these strategies, you can better position yourself to choose banking products that align with your financial goals, while minimizing unnecessary fees.

Proactive Steps to Challenge and Negotiate Bank Fees

When it comes to banking, many customers often overlook the opportunity to challenge and negotiate fees. Understanding how to approach this can lead to significant savings. Here are proactive steps you can take:

- Know Your Fees: Start by reviewing your bank statements to identify all the fees charged, such as monthly maintenance fees, overdraft fees, and ATM charges.

- Research Competitors: Compare your bank’s fees with those from other banks. If a competitor offers lower fees, mention this when you negotiate.

- Be Prepared with Your History: Have your banking history ready, showing that you are a loyal customer. Highlight any positive relationships, like keeping a minimum balance or not overdrawing your account frequently.

- Use the Right Timing: Approach your bank during their less busy hours for a better chance of speaking with a representative who can make decisions. Early mornings or mid-afternoons are often ideal.

- Be Polite but Firm: When speaking to a bank representative, maintain a respectful tone while being assertive about your request. Clearly state the fee you wish to negotiate.

- Ask Directly for Specific Reductions: Whether it’s a monthly fee reduction or waiving an overdraft fee, be clear about what you are asking for. For instance, “I’d like to request a waiver for my recent overdraft fee of $35.”

- Follow Up in Writing: After your call, consider sending a follow-up email summarizing your conversation and reiterating your request. This creates a formal record of your negotiation.

| Type of Fee | Typical Amount | Negotiation Tips |

|---|---|---|

| Monthly Maintenance Fee | $10 – $20 | Request a reduction or ask for it to be waived if you maintain a certain balance. |

| Overdraft Fee | $25 – $35 | Negotiate based on your banking history and express that this is a rare occurrence. |

| ATM Charges | $3 – $5 per transaction | Ask if they offer a refund for out-of-network ATM fees or if they can waive it for being a long-term customer. |

Taking these steps can empower you to negotiate effectively and potentially reduce your bank fees significantly. Remember, banks are often willing to work with you, especially if you express your loyalty and willingness to stay with them.

Future Outlook

As we conclude our journey through the labyrinth of bank fees, it’s clear that awareness is your strongest ally. By familiarizing yourself with the common pitfalls-like overdraft charges and maintenance fees-you can strategically navigate your financial landscape with confidence. Remember, your money deserves to stay in your pocket rather than line bank coffers. Whether it’s negotiating for better terms or simply choosing the right institution, every effort counts. Keep these insights close, and let them guide you in sidestepping those sneaky fees, ensuring that your hard-earned money works as hard as you do. Let the empowerment of knowledge lead you forward, and enjoy a banking experience that truly serves you.