In an ever-evolving financial landscape, managing one’s budget can feel daunting, especially for beginners. As the digital age offers a plethora of tools, smart money management apps have emerged as essential companions for those embarking on their financial journeys. For Indian beginners keen to stretch their rupees further without compromising their aspirations, these apps provide an invaluable resource. From tracking expenses to setting savings goals, they blend technology with user-friendly interfaces, making financial literacy accessible to all. Whether you’re a student navigating the complexities of monthly expenses or a young professional laying the groundwork for future investments, there’s an app tailored for your needs. Join us as we explore the top smart money management apps designed to empower Indian users on a budget.

Exploring User-Friendly Budgeting Features of Smart Money Management Apps

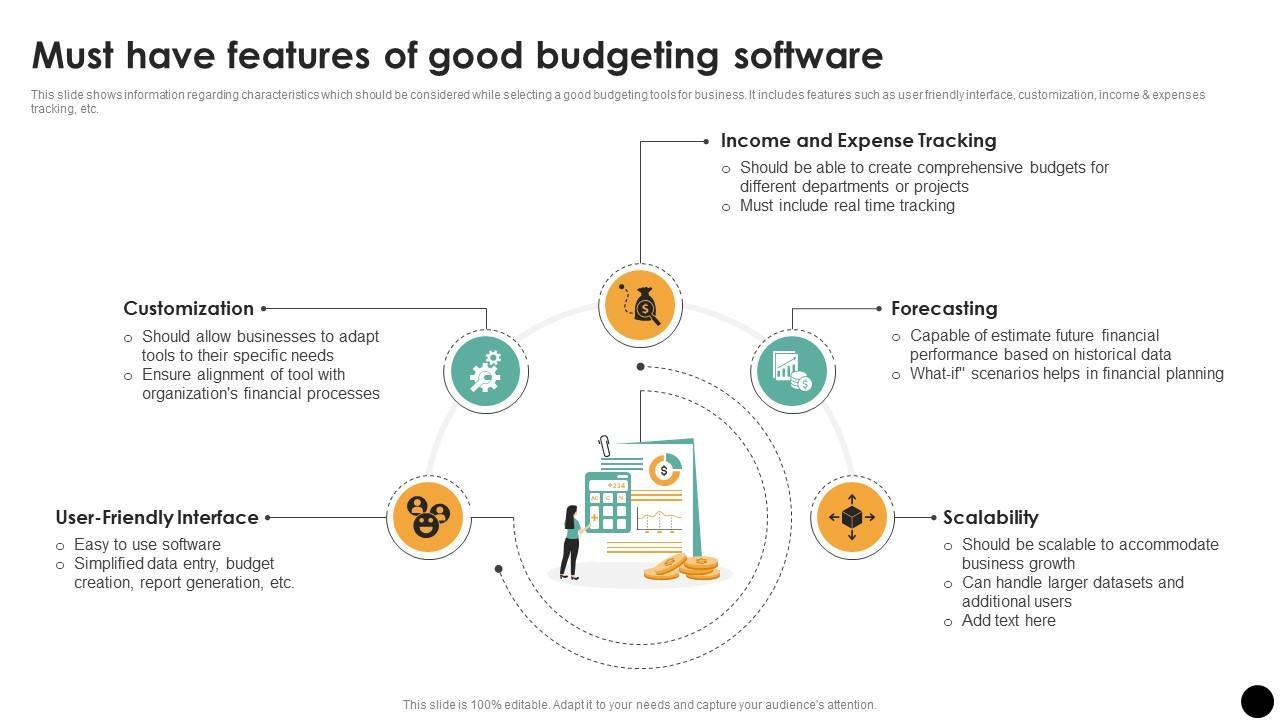

Managing finances can be daunting, especially for beginners. Fortunately, smart money management apps are designed to simplify budgeting and make it more accessible. These applications often come equipped with features that allow users to:

- Track Expenses: Easily categorize and monitor spending habits in real time.

- Set Budgets: Create personalized budgets based on income and expenditure patterns.

- Goal Setting: Facilitate savings for specific goals, whether it’s a vacation or an emergency fund.

- Receive Alerts: Get notified when you exceed budget limits or when bills are due.

Moreover, these apps often provide insightful analytics that help users understand their financial health. They might include:

- Visual Reports: Graphical representations of income, expenses, and savings trends over time.

- Import/Export Data: Simple options to import data for seamless tracking across platforms.

- Secure Transactions: Ensure sensitive financial information is encrypted and secure.

Essential Expense Tracking: How These Apps Simplify Your Financial Journey

Managing finances has become easier with the rise of innovative apps tailored for users on a budget. These tools enable beginners to keep a close eye on their day-to-day expenses without the complexity often found in traditional accounting methods. By offering features such as automatic categorization of transactions and visual spending reports, users can quickly identify where their money is going. Some of the standout functionalities include:

- Real-time tracking: Monitor your expenses as they happen.

- Customizable budgets: Set limits for different spending categories.

- Reminders: Get notifications for upcoming bills and expenses.

Furthermore, these applications often come with user-friendly interfaces that demystify financial management for those just starting their journey. Many options cater specifically to the Indian market, accommodating local currency and payment methods. Shared accountability features allow users to manage joint expenses easily, making them perfect for families or roommates. Below is a comparison of some popular expense tracking apps:

| App Name | Key Feature | Cost |

|---|---|---|

| Spend Sense | Budget Planning | Free |

| Money Manager | Expense Tracking | ₹199 (Annual) |

| nT-wallet | Bill Payments | Free |

Investment Opportunities for Beginners: Making Your Money Work

For beginners looking to make their money work effectively, leveraging smart money management apps can serve as an essential first step. These applications typically enable users to set budgets, track expenses, and explore various investment opportunities without feeling overwhelmed. Here are some key features to look for:

- User-Friendly Interface: A simple design that makes navigation easy.

- Budget Tracking: Keeping an eye on income versus expenses.

- Investment Insights: Access to resources and advice for beginner-friendly investments.

Moreover, many apps offer the ability to start investing with minimal amounts, making them ideal for users on a budget. A comparison of a few popular options reveals their unique advantages:

| App Name | Minimum Investment | Key Features |

|---|---|---|

| Groww | ₹500 | Mutual funds, stocks, and digital gold |

| Paytm Money | ₹100 | Stocks and mutual funds with educational resources |

| ET Money | ₹500 | Diverse investment options with expense tracking |

Maximizing Savings: Best App Tools for Financial Goals and Emergency Funds

In today’s digital age, leveraging technology to manage finances has never been easier, especially for beginners seeking to maximize their savings. Numerous applications cater specifically to budgeting and financial goals, making them essential tools for anyone looking to develop a secure financial future. Some popular choices include:

- Mint: This app offers comprehensive budgeting features and tracks your spending, allowing you to set financial goals with ease.

- YNAB (You Need a Budget): Ideal for those who want to gain a better understanding of their income and expenses, YNAB emphasizes proactive budgeting.

- Wally: A user-friendly interface makes Wally excellent for tracking expenses while managing multiple currencies, perfect for frequent travelers.

For individuals focusing on building an emergency fund, apps like Qapital and Digit can automate savings by rounding up purchases and setting aside spare change. This gamified approach not only makes saving fun but also gradual, minimizing the impact on daily life. To help streamline the selection process, here is a simple comparison of these applications:

| App | Key Feature | Cost |

|---|---|---|

| Mint | Budget tracking & goal setting | Free |

| YNAB | Proactive budgeting | $84/year |

| Wally | Multi-currency support | Free |

| Qapital | Automated savings | $3-$12/month |

| Digit | Round-up savings | $5/month |

Final Thoughts

As we navigate the labyrinth of personal finance, embracing technology can be a game-changer, especially for Indian beginners keen on stretching their budgets. The plethora of smart money management apps available-designed with user-friendliness and functionality in mind-empowers you to track expenses, set savings goals, and make informed financial decisions. Whether you’re looking to curb your spending or plan for future investments, these tools can turn financial chaos into clarity. By taking advantage of these apps, you’re not just managing your money; you’re cultivating a healthier financial future. So why wait? Dive in, explore the options, and start your journey towards smarter financial habits today.