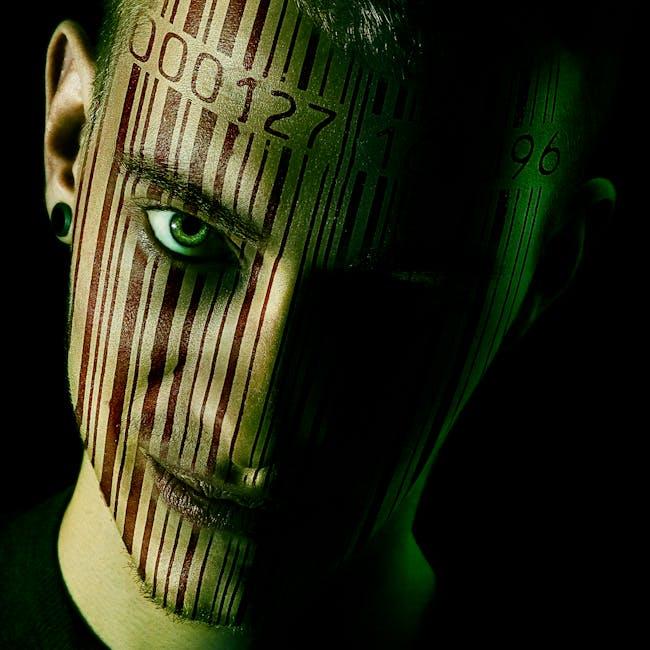

In a digital age where personal information is just a click away, identity theft has emerged as a pressing concern for many. Victims of this insidious crime often find themselves grappling not only with the emotional turmoil of having their identity stolen but also with the daunting task of restoring their credit and financial security. In this article, we will explore practical steps you can take to safeguard your credit and provide a comprehensive guide on how to report identity theft effectively. Whether you’re a victim or simply looking to enhance your defenses against potential threats, understanding the mechanisms of identity theft and your rights as a consumer is crucial. Let’s delve into the essential strategies for protecting your personal information and tackling identity theft head-on.

Understanding the Signs of Identity Theft and Its Impact

Identity theft can happen to anyone, and understanding its signs is essential to protect yourself and your credit. Recognizing these indicators early can help mitigate potential damage, and respond effectively to any breaches in your identity. Here are some key signs that may suggest you are a victim of identity theft:

- Unfamiliar Transactions: Review your bank and credit card statements regularly. If you see charges or withdrawals that you don’t recognize, it could be a sign that someone is misusing your account.

- New Accounts You Didn’t Open: If you receive mail from a bank or creditor for an account you didn’t open, it may indicate that someone has used your information to apply for credit.

- Credit Report Issues: Regularly check your credit report for errors or unfamiliar accounts. You can request a free credit report annually from each of the three credit bureaus: Equifax, Experian, and TransUnion.

- Receiving Collection Calls: If you receive calls from debt collectors about debts you didn’t incur, it could signal that your personal information has been compromised.

- Tax-related Notices: If you receive a notice from the IRS indicating that more than one tax return was filed in your name, this could be a red flag of identity theft.

- Missing Bills: If your bills stop arriving, it could indicate that someone has changed your billing address to hide their fraudulent activity.

The impact of identity theft can be profound and far-reaching. Here are some potential consequences:

- Financial Loss: Identity theft can result in significant financial losses, as thieves may drain bank accounts or rack up credit card debts in your name.

- Credit Damage: Unauthorized accounts and unpaid debts can severely impact your credit score, making it difficult to qualify for loans or mortgages in the future.

- Emotional Distress: The stress and anxiety of dealing with identity theft can affect your mental well-being, leading to feelings of vulnerability and frustration.

- Legal Complications: You may need to resolve legal issues arising from fraudulent activities conducted in your name, which can be time-consuming and complicated.

Being proactive in monitoring your financial statements and credit reports is vital. By staying vigilant and recognizing the signs of identity theft, you can better safeguard your identity and financial health.

Essential Steps to Take Immediately After Discovering Identity Theft

Discovering that you’ve fallen victim to identity theft can be overwhelming. However, acting swiftly can help mitigate damage and protect your financial future. Here are essential steps to take immediately:

- Place a Fraud Alert: Contact one of the three major credit bureaus-Experian, TransUnion, or Equifax-to place a fraud alert on your credit report. This makes it harder for identity thieves to open accounts in your name.

- Review Your Credit Reports: Obtain a free copy of your credit report from AnnualCreditReport.com. Check for any unfamiliar accounts or inquiries.

- Report to the FTC: Visit the Federal Trade Commission’s website and file an identity theft report. This report is crucial for disputing fraudulent charges and obtaining a recovery plan.

- Contact Your Financial Institutions: Notify your bank, credit card companies, and any relevant creditors about the theft. They can assist you in freezing accounts and disputing unauthorized transactions.

- File a Police Report: Report the identity theft to your local police department. Provide them with the FTC report, any fraudulent charges, and your identification.

| Action | Contact Information | Notes |

|---|---|---|

| Experian | Experian.com | Call 1-888-397-3742 to place a fraud alert. |

| TransUnion | TransUnion.com | Call 1-800-680-7289 for a fraud alert. |

| Equifax | Equifax.com | Call 1-800-349-9960 for assistance. |

Document Everything: Keep a detailed record of all communications and transactions related to the theft. This documentation will be invaluable in resolving disputes.

- Consider a Credit Freeze: If you want to take extra precaution, you can request a credit freeze, which prevents new creditors from accessing your credit report.

- Monitor Your Accounts: Regularly check your bank and credit card statements for unauthorized transactions. If you spot any, report them immediately.

- Stay Vigilant: Continue monitoring your credit reports and accounts for at least a year. Use credit monitoring services if possible.

Acting quickly and thoroughly can help restore your identity and safeguard your credit. Don’t hesitate to seek assistance from legal or financial professionals if needed.

How to Effectively Report Identity Theft to the Authorities

Experiencing identity theft can be overwhelming, but taking timely action is crucial. Reporting identity theft to the authorities is a vital step in regaining control over your identity and finances. Here’s how you can effectively report identity theft:

- Document Everything: Keep detailed records of any suspicious activity, including dates, amounts, and descriptions of fraudulent transactions. This information will be invaluable when reporting the theft.

- File a Report with the Federal Trade Commission (FTC): Visit the FTC’s Identity Theft website to file a report. This will provide you with a recovery plan and a record of your claim.

- Contact Your Local Police: File a police report with your local law enforcement agency. Bring copies of your FTC report and any evidence of identity theft to support your case.

- Notify Your Banks and Creditors: Immediately inform your banks and credit card companies of the theft. They can help you stop unauthorized transactions and may offer additional assistance.

Key Contacts

| Agency | Contact Information |

|---|---|

| FTC (Federal Trade Commission) | identitytheft.gov | 1-877-438-4338 |

| Your Local Police Department | Find your local police contact via the police department website. |

| Credit Bureaus | Equifax: 1-800-349-9960 Experian: 1-888-397-3742 TransUnion: 1-888-909-8872 |

- Place a Fraud Alert: Contact one of the three major credit bureaus to place a fraud alert on your credit report. This will make it harder for identity thieves to open accounts in your name.

- Consider a Credit Freeze: A credit freeze prevents creditors from accessing your credit report until you lift the freeze. This can be an effective way to stop further misuse of your identity.

- Monitor Your Accounts: Regularly check your bank and credit card statements for unauthorized activity. Set up alerts through your bank for any transactions that exceed a specified amount.

Taking these steps helps secure your identity and minimizes the damage caused by identity theft. Remember, the sooner you act, the better your chances of recovery.

Strategies for Rebuilding Your Credit Post-Identity Theft

Rebuilding your credit after experiencing identity theft can feel daunting, but with the right approach, you can regain control of your financial health. Here are effective strategies to guide you through the recovery process:

- Notify Creditors: Contact your credit card companies and lenders immediately to freeze or close your accounts. This limits further fraudulent activity.

- Review Your Credit Reports: Obtain free credit reports from all three major credit bureaus-Equifax, Experian, and TransUnion-at AnnualCreditReport.com. Look for unauthorized accounts or inquiries.

- Dispute Incorrect Information: If you find inaccuracies, file disputes with each credit bureau. They are required to investigate and respond within 30 days.

- Place a Fraud Alert: Set up a fraud alert on your credit report by contacting one of the credit bureaus. This makes it harder for identity thieves to open accounts in your name.

- Consider a Credit Freeze: A credit freeze restricts access to your credit report, making it nearly impossible for identity thieves to open accounts. You can temporarily lift it when needed.

- Establish a Payment Plan: If identity theft has impacted your ability to pay debts, negotiate with creditors for a payment plan or settlement. Many lenders offer hardship programs.

- Monitor Your Credit Regularly: Utilize credit monitoring services, some of which are free, to keep an eye on changes to your credit report and score.

- Rebuild with Secured Credit Cards: Consider applying for a secured credit card to help rebuild your credit. These require a security deposit and can improve your score with responsible use.

| Action | Description |

|---|---|

| Credit Freeze | Prevents creditors from accessing your credit file, protecting you from new debts incurred by identity thieves. |

| Fraud Alert | Warns creditors to take extra steps to verify your identity before opening new accounts. |

| Secured Credit Card | A credit card backed by a cash deposit; useful for rebuilding credit responsibly. |

By taking these proactive steps, you’ll not only address the immediate fallout from identity theft but also lay a solid foundation for a healthier credit profile moving forward. Remember, patience and persistence are key during this process.

Concluding Remarks

In today’s digital landscape, safeguarding your credit is more vital than ever. By understanding the steps to report identity theft, you empower yourself to mitigate potential damage and regain control. Remember, vigilance is your first line of defense-monitor your accounts regularly and consider placing a fraud alert or credit freeze if you suspect anything amiss. As you navigate this process, remain proactive and informed, ensuring that your financial health remains robust. Should you find yourself a victim, acting swiftly can make all the difference. Stay safe and secure, and take the necessary measures to protect your identity.