In today’s fast-paced world, financial emergencies can arise unexpectedly, making access to quick funds crucial. As the demand for instant loans grows, so does the necessity for reliable and trustworthy lending solutions. Enter the instant loan apps, designed to provide fast access to cash with minimal hassle. However, navigating the landscape of digital lending can be daunting, especially with a plethora of options available. This is where the approval of the Reserve Bank of India (RBI) becomes a key factor-signifying that these apps adhere to stringent regulatory standards. In this article, we will explore the most reliable instant loan apps you can count on, ensuring you have the peace of mind when seeking urgent financial assistance. Discover apps that not only offer quick loans but also uphold integrity and security, making them a trustworthy choice in your financial toolkit.

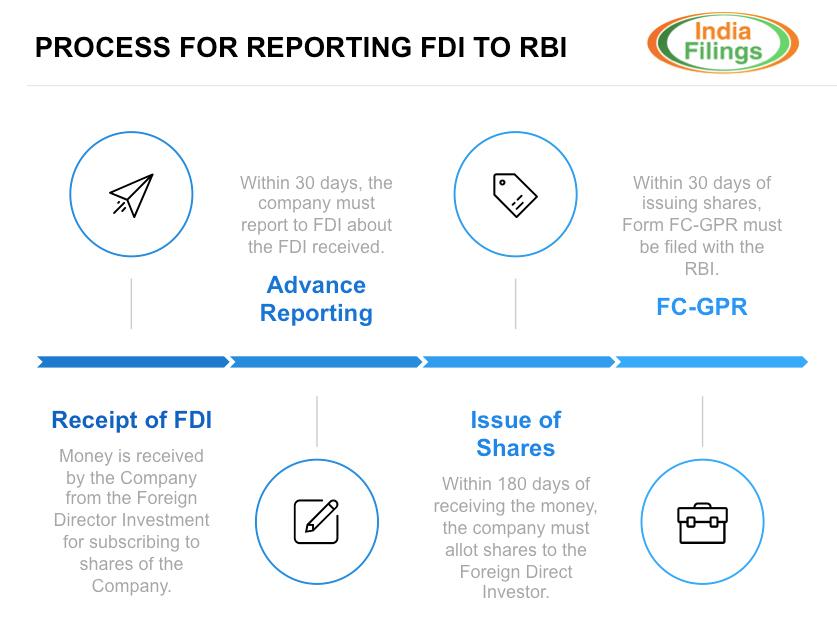

Understanding the RBI Approval Process for Instant Loan Apps

The Reserve Bank of India (RBI) plays a crucial role in regulating and approving instant loan applications to ensure financial stability and consumer protection. The approval process involves a comprehensive evaluation of the app’s compliance with regulatory standards, including transparency in terms and conditions, interest rates, and data privacy. Apps must also demonstrate their capacity to assess creditworthiness responsibly. Key aspects of this process include:

- Regulatory Compliance: Adherence to India’s banking regulations is mandatory.

- Transparency: Clear disclosure of fees and charges is essential.

- Consumer Protection: Mechanisms must be in place to address grievances.

Furthermore, the RBI emphasizes the importance of technology in the approval process. Instant loan apps are required to implement robust security measures for user data and employ effective algorithms for risk assessment. The ongoing monitoring of approved apps ensures compliance with evolving guidelines. The following table summarizes the critical elements of RBI’s assessment criteria:

| Criterion | Description |

|---|---|

| Documentation | Verification of legal documentation and financial records. |

| User Data Security | Implementation of industry-standard encryption protocols. |

| Credit Assessment Technology | Utilization of advanced analytics for credit scoring. |

Key Features to Look for in Trusted Loan Applications

When searching for reliable instant loan applications, it’s essential to prioritize features that ensure security and transparency. Look for apps that are RBI-approved and have a strong reputation for protecting user information. Key aspects to consider include:

- User Reviews: Check app ratings and testimonials from other users to gauge satisfaction and reliability.

- Clear Terms and Conditions: Trusted apps provide transparent terms regarding fees, interest rates, and repayment schedules.

- Robust Customer Support: Accessible customer service is critical for resolving issues and answering queries.

Additionally, consider apps that offer personalized loan options tailored to your specific needs. This can enhance your borrowing experience and ensure better financial outcomes. Important features include:

- Flexible Repayment Plans: Ability to choose repayment schedules that align with your income cycle.

- Quick Disbursal Process: Look for apps with fast processing times for loan approval and disbursal.

- In-App Financial Tools: Many trusted apps provide calculators and budgeting tools to help manage your finances effectively.

Top Rated Instant Loan Apps You Can Rely On

In today’s fast-paced world, instant loan apps have become essential for managing unexpected expenses. These platforms offer a seamless experience, allowing users to secure funds swiftly and effortlessly. Popular choices include:

- PaySense: Known for its user-friendly interface and flexible repayment options.

- CASHe: Ideal for young professionals, offering quick loans based on salary and credit history.

- MoneyView: Not only provides loans but also helps you manage your finances efficiently.

Each app is designed with customer needs in mind, ensuring reliability and security. Factors such as interest rates, repayment terms, and approval times are crucial when selecting the right app. Consider the following table to compare some of the best options:

| App Name | Interest Rate | Loan Amount | Approval Time |

|---|---|---|---|

| PaySense | 12% – 36% | ₹5,000 – ₹5,00,000 | Within 2 hours |

| CASHe | 13% – 24% | ₹1,000 – ₹3,00,000 | Instant |

| MoneyView | 15% – 30% | ₹10,000 – ₹10,00,000 | Within 24 hours |

Navigating Terms and Conditions for a Seamless Loan Experience

Understanding the fine print of loan applications is crucial for a smooth borrowing experience. Often, the terms and conditions can be packed with jargon, making it easy to overlook important details. Here are some key aspects to keep in mind:

- Interest Rates: Check whether the rate is fixed or variable.

- Fees: Be aware of application fees, processing fees, and any prepayment penalties.

- Loan Terms: Understand the duration of repayment and the impact on your monthly payments.

- Eligibility Criteria: Review the requirements to ensure you meet them before applying.

Additionally, taking the time to read the entire agreement can save you from unexpected issues down the line. Consider creating a simple comparison table of various loan apps to summarize their offerings:

| Loan App | Interest Rate | Max Loan Amount | Repayment Period |

|---|---|---|---|

| App A | 12% – 20% | $5,000 | 1-3 Years |

| App B | 10% – 18% | $10,000 | 2-4 Years |

| App C | 15% – 25% | $7,500 | 6 Months – 2 Years |

The Way Forward

In a world driven by immediate needs and shifting financial landscapes, having access to reliable loan solutions is essential. The instant loan apps approved by the RBI stand out not just for their quick processes, but also for their commitment to regulatory compliance and user security. As we navigate the digital lending space, these platforms offer a beacon of hope for those seeking financial assistance without the lengthy bureaucratic entanglements. Always remember to read the terms and conditions carefully and choose the app that best aligns with your financial goals. With the right tools at your fingertips, a brighter, more secure financial future is only a few clicks away.