In today’s access/” title=”Unlocking Loans with Aadhaar Alone for Hassle-Free …”>fast-paced financial landscape, the quest for wealth maximization often leads individuals to explore a myriad of investment avenues. Among the most accessible yet often overlooked strategies is the power of high-interest savings accounts and other saving tools designed to yield substantial returns on your deposits. By understanding the potential of compounding interest and strategically selecting savings vehicles, you can make your money work harder for you. In this article, we will delve into various high-interest saving strategies that not only safeguard your capital but also enhance your wealth over time, empowering you to achieve your financial goals with confidence.

Understanding High Interest Savings Accounts and Their Benefits

High interest savings accounts (HISAs) are powerful financial tools designed to help individuals grow their savings efficiently. Unlike traditional savings accounts that offer minimal interest, HISAs typically provide more lucrative rates, allowing your money to work harder for you. Key benefits of HISAs include:

- Higher Interest Rates: HISAs often yield interest rates significantly above average, enabling quicker wealth accumulation.

- Liquidity: Funds remain accessible, allowing for quick withdrawals without penalties.

- No Risk: HISAs are usually insured, providing safety for your deposits.

- Simple Savings Strategy: They offer an effortless way to set aside money while earning interest.

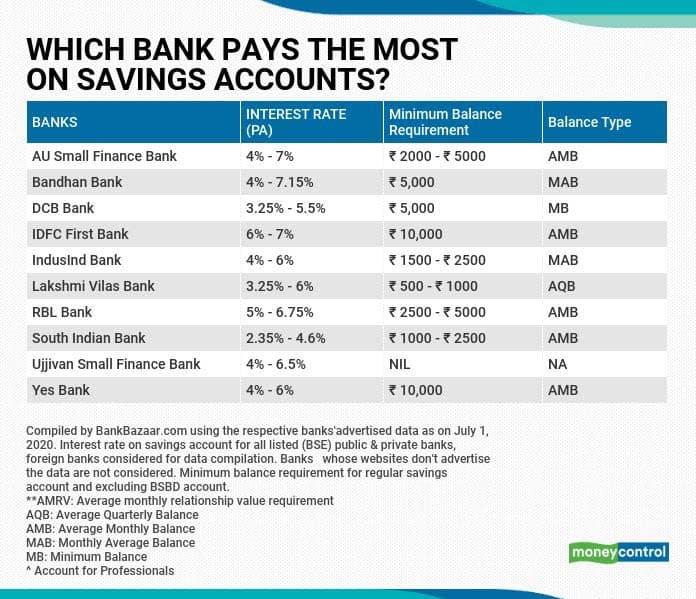

To maximize the benefits of a high interest savings account, consider these strategies. Regular contributions can amplify your savings, benefiting from compound interest over time. Additionally, compare different banks and financial institutions to secure the best rates available in the market, such as Tangerine’s offer of 3.65% available until August 31, 2025. Below is a simple table showcasing recent interest rates:

| Bank | Interest Rate |

|---|---|

| Tangerine | 3.65% |

| Hubert Financial | 2.00% |

| PC Financial | 3.10% |

| Neo Financial | 2.50% |

Exploring Alternative Savings Vehicles for Enhanced Returns

When seeking to enhance your savings returns, traditional savings accounts may not always provide the growth needed to achieve financial goals. Alternative savings vehicles can offer higher interest rates and potential for increased wealth accumulation. Consider exploring:

- High-Yield Savings Accounts: Often offered by online banks, these accounts typically feature higher interest rates compared to standard savings options.

- Certificates of Deposit (CDs): Investing in CDs allows you to lock in a fixed interest rate over a predetermined term, often yielding better returns than traditional savings accounts.

- Money Market Accounts: These combine features of savings and checking accounts, generally offering higher interest rates and easier access to funds.

- Peer-to-Peer Lending: Investing in peer-to-peer platforms can provide attractive returns, albeit with higher risk as you directly lend to individuals or businesses.

Additionally, consider diversifying your approach by allocating funds to potential growth areas. Riskier options may come with higher volatility but can significantly boost overall returns. Some strategies to consider include:

| Investment Type | Estimated Return | Risk Level |

|---|---|---|

| Stocks | 7-10% | High |

| Bonds | 4-6% | Moderate |

| REITs | 8-12% | Moderate to High |

| Cryptocurrency | Varies | Very High |

Strategies for Choosing the Right High Interest Savings Option

When selecting the ideal high-interest savings option, it’s essential to consider a few key factors. Start by comparing interest rates across various financial institutions. Some banks and credit unions offer promotional rates that can significantly boost your savings for an introductory period. However, ensure that these rates are not temporary; look for options with competitive ongoing rates. Additionally, keep an eye on minimum balance requirements and fees associated with the account. High fees can erode your interest earnings, so opt for accounts that align with your financial habits.

Consider the flexibility and accessibility of your savings account as well. Some savings options offer limited withdrawals, while others provide unlimited access. Assess your liquidity needs to avoid penalties or fees for early withdrawals. Furthermore, look into the FDIC insurance or similar protections to safeguard your funds. A comparison table might help visualize these options:

| Bank/Credit Union | Interest Rate | Minimum Balance | Access Type |

|---|---|---|---|

| Bank A | 2.50% | $500 | Unlimited |

| Bank B | 2.75% | $1,000 | Limited |

| Bank C | 2.20% | $0 | Unlimited |

Maximizing Your Wealth Through Smart Savings Habits and Planning

To truly enhance your financial future, embrace high-interest savings accounts that amplify your hard-earned money. These accounts often offer significantly better rates than traditional savings banks, giving you the opportunity to enjoy compounded interest over time. When selecting a high-interest account, consider the following key factors:

- Interest Rate: Look for competitive rates that maximize your earnings.

- Fees: Be aware of monthly maintenance fees that could eat into your returns.

- Access: Ensure you have easy access to your funds without penalties.

- FDIC Insurance: Choose accounts that are insured to protect your savings.

In addition to selecting the right savings vehicle, implementing strategic savings habits can significantly boost your wealth. Setting up an automatic transfer from your checking to your high-interest savings account could be a game changer. Coupling this with a budget allows you to properly allocate funds toward savings goals. Consider using a simple table to track your monthly contributions and growth potential:

| Month | Savings Contribution | Projected Interest Earned |

|---|---|---|

| January | $300 | $2.50 |

| February | $300 | $5.00 |

| March | $300 | $7.50 |

By actively engaging in these practices, not only can you safeguard your wealth, but also set the foundation for future financial prosperity.

Key Takeaways

In closing, maximizing your wealth through high interest saving strategies requires a thoughtful approach and an eye for opportunities. By exploring various options-whether it’s high-yield savings accounts, certificates of deposit, or innovative online banks-you can pave the way to financial growth. Remember, the key lies in diligent research and finding the right balance that suits your financial goals. As you embark on this journey, stay informed and adaptable, and let your savings work harder for you. With the right strategies in place, you can nurture your wealth and build a foundation for a more secure future. Embrace the possibilities, and watch your financial aspirations flourish.