In a world where financial independence is often just a signature away, mastering the art of securing a loan without a cosigner can be a game-changer. Whether you’re a recent graduate stepping into adulthood or an entrepreneur striving to expand your business, the ability to navigate this process confidently opens doors to opportunities that might otherwise remain closed. This article will guide you through the essential steps, considerations, and strategies needed to successfully obtain a loan on your own, empowering you to take control of your financial future without relying on others. Join us as we demystify the journey, providing you with insights that can lead to lasting financial success.

Understanding Creditworthiness and Financial Stability

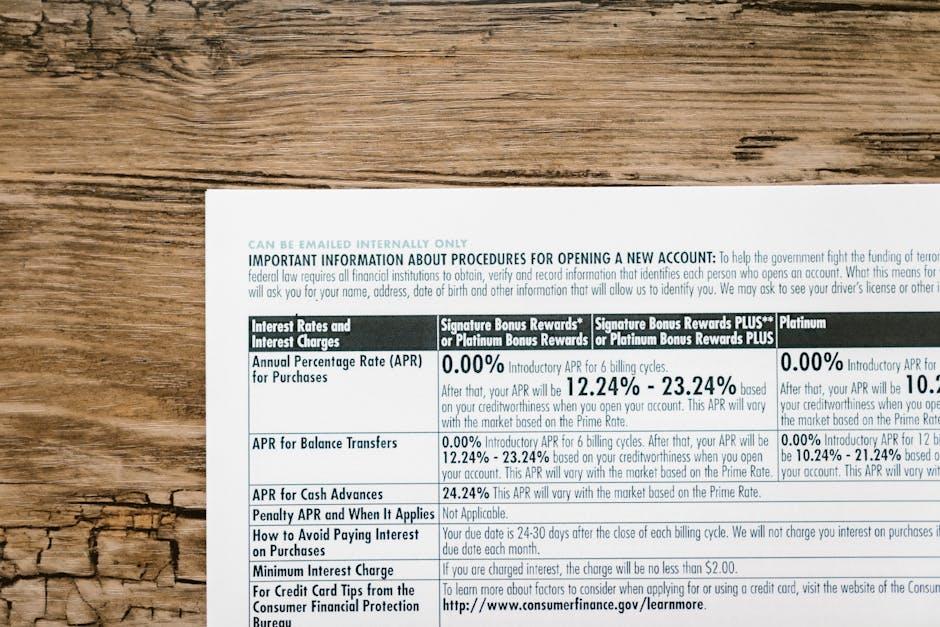

When it comes to securing a loan without a cosigner, understanding your creditworthiness and financial stability is essential. These two factors play a pivotal role in how lenders assess your eligibility and determine the terms of your loan. Here’s how these concepts interact and what you need to know:

Creditworthiness is essentially a measurement of your ability to repay borrowed money. It is primarily assessed through your credit score, which ranges from 300 to 850. A higher score indicates greater creditworthiness. Key elements influencing your credit score include:

- Payment History: Consistently making on-time payments can significantly boost your score.

- Credit Utilization: This refers to the average amount of credit you’re using compared to your total credit limit. Keeping this under 30% is ideal.

- Length of Credit History: A longer credit history can positively affect your score, as it shows responsible credit management over time.

- Types of Credit: A mix of credit accounts (credit cards, loans, mortgages) can enhance your score.

- Recent Credit Inquiries: Frequent applications for new credit can negatively impact your score.

Financial Stability complements creditworthiness and encompasses your income, employment history, debts, and savings. Lenders look for borrowers who demonstrate stable financial practices. Consider these factors:

- Income Stability: A steady job or regular income stream signals to lenders that you have the means to repay the loan.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI (below 36%) indicates better financial health.

- Emergency Savings: Having savings set aside can give lenders confidence in your ability to manage unexpected expenses or changes in income.

- Employment History: A consistent employment record suggests reliability and less risk for lenders.

| Factor | Importance |

|---|---|

| Payment History | Most significant factor in credit scoring |

| Credit Utilization | Aim for below 30% for optimal score |

| Income Stability | Proof of reliable income helps secure loans |

| Debt-to-Income Ratio | Lower ratios indicate better financial management |

To improve your creditworthiness and financial stability:

- Pay bills on time and avoid late payments.

- Monitor your credit report regularly for errors.

- Consider paying down existing debts to reduce your credit utilization and DTI.

- Establish an emergency fund to manage unexpected expenses.

By enhancing your creditworthiness and demonstrating financial stability, you position yourself as a low-risk borrower, making it easier to secure a loan without the need for a cosigner.

Exploring Alternative Loan Options for Independent Borrowers

For independent borrowers, exploring alternative loan options can be a vital step toward securing financing without the necessity of a cosigner. In today’s lending landscape, numerous institutions offer various avenues tailored to meet the unique needs of those looking to establish or improve their credit while accessing the funds they need.

Here are some prominent alternative loan options:

- Credit Unions: Often more flexible than traditional banks, credit unions typically offer lower interest rates and are more willing to work with borrowers who may have less-than-perfect credit scores.

- Online Lenders: Platforms like Prosper and LendingClub provide peer-to-peer lending solutions, where individuals can get funds directly from investors. These loans often have specific minimum credit requirements but can offer competitive rates.

- Personal Installment Loans: Many lenders, including Authorize.net, provide personal loans based on income rather than credit history. These can be an excellent choice for those who can demonstrate steady employment and income.

- Secured Loans: If you have assets such as a car or savings account, a secured loan allows you to use those as collateral. This often makes you eligible for better terms and lower interest rates.

- Specialty Lenders: Some lenders specialize in loans for specific groups, such as military veterans or students. For example, the Department of Defense offers special loan programs for veterans that can significantly lower borrowing costs.

When pursuing alternative loan options, be mindful of the following factors:

- Interest Rates: Compare rates across multiple lenders to find the best deal. Use online comparison tools to gauge which loans may be more favorable based on your credit profile.

- Loan Terms: Understand the repayment terms, including the length of the loan and any applicable fees. Be wary of loans with long durations that may accrue more interest over time.

- Eligibility Requirements: Each lender has its own criteria. Ensure you know what documents you’ll need and any minimum requirements that might affect your approval.

Consider using a credit score calculator or engaging with financial advisors for advice tailored to your financial situation. Knowing your credit score can help you navigate the best options available.

Here’s a helpful comparison of some popular alternative loan options:

| Loan Type | Typical Interest Rate | Repayment Term | Credit Score Requirement |

|---|---|---|---|

| Credit Union Loans | 6% – 18% | 1 – 5 years | Varies (lower required) |

| Online Personal Loans | 5% – 36% | 3 – 5 years | 600 and above |

| Secured Loans | 3% – 15% | 2 – 7 years | Varies based on collateral |

| Unsecured Personal Loans | 10% – 35% | 2 – 7 years | 580 and above |

Exploring these options can empower independent borrowers to find financing solutions that best suit their financial needs and help them achieve their goals.

Building a Strong Loan Application Without a Cosigner

When you’re aiming to secure a loan without a cosigner, crafting a robust loan application is essential. Here are some key strategies to enhance your application and increase the likelihood of approval:

- Understand Your Credit Score: Your credit score is a critical factor that lenders assess. Typically, a score of 700 or above is considered good. Check your score for free through services like AnnualCreditReport.com.

- Improve Your Credit Profile: If your score isn’t favorable, take steps to boost it before applying. Pay off outstanding debts, make all payments on time, and limit new credit inquiries.

- Gather Documentation: Prepare necessary documents that may include:

| Document Type | Description |

|---|---|

| Identification | Government-issued ID, such as a driver’s license or passport. |

| Proof of Income | Recent pay stubs, tax returns, or bank statements to verify income. |

| Employment Verification | A letter from your employer confirming your position and salary. |

| Debt-to-Income Ratio | Compile your monthly debts such as credit card payments, rent, or student loans. |

- Choose the Right Lender: Research lenders who specialize in loans for individuals without cosigners. Consider exploring credit unions and community banks, as they may offer personalized service with better rates.

- Apply for the Right Amount: Be realistic about how much you need. A smaller loan amount may be easier to qualify for, demonstrating responsible borrowing.

- Consider Prequalification: Many lenders offer a prequalification process where you can check your potential loan terms without impacting your credit score. Use this to your advantage to find the best fit.

- Be Honest in Your Application: Full transparency with your financial situation fosters trust. Lenders will appreciate your honesty, which can help pave the way for a smoother application process.

Incorporating these strategies can significantly strengthen your loan application and improve your chances of securing funding without a cosigner. Take the time to prepare thoroughly, and approach the lending process with confidence.

Strategies to Improve Approval Chances and Secure Favorable Terms

When it comes to securing a loan without a cosigner, improving your chances of approval and obtaining favorable terms is essential. Here are several effective strategies that can help you navigate this process successfully:

- Boost Your Credit Score: Your credit score plays a pivotal role in loan approvals. Aim for a score of 700 or higher to increase your chances of accessing better loan terms. To improve your score:

- Pay off any existing debts to lower your debt-to-income ratio.

- Ensure you make all payments on time, as late payments can significantly impact your score.

- Keep your credit utilization below 30% by not maxing out credit cards.

- Maintain a Steady Income: Lenders prefer borrowers with stable income sources. If possible, show consistent employment history, ideally over two years. Review your income documents like pay stubs and tax returns to ensure they reflect a solid financial picture.

- Gather Strong Financial Documentation: Prepare a comprehensive set of financial documents to demonstrate your capability to repay the loan. This may include:

- Pay stubs and tax returns for the past two years.

- Bank statements showing savings and other assets.

- Documentation for any additional income sources, such as freelance work or investments.

- Choose the Right Lender: Each lender has different criteria for approving loans. Research and compare options from various banks and credit unions to find one that aligns with your financial situation. Look into:

- Online lenders, which may offer faster approvals.

- Local credit unions, often providing lower interest rates and more personalized service.

- Consider a Secured Loan: If you’re open to it, a secured loan using an asset (like a savings account or car) can lower risk for lenders and increase your chances of approval. This often comes with lower interest rates, as the lender has collateral.

- Limit Your Loan Amount: Applying for a smaller loan can be easier to secure, especially if your credit profile may not be strong enough for larger amounts. Consider what you really need, and you might find that a lower amount meets your needs effectively.

- Be Prepared for Questions: During the application process, expect inquiries about your financial history and goals. Being ready to discuss your financial situation openly and honestly can build trust with your lender.

- Start Early: Don’t wait until the last minute. Apply for loans well ahead of your timeline for need. This gives you time to address any potential hurdles without pressure.

By implementing these strategies, you will not only improve your chances of loan approval without a cosigner but also secure better terms, making your financial journey smoother.

To Wrap It Up

In conclusion, navigating the world of loans without a cosigner can seem daunting, but with the right strategies and knowledge, you can unlock the funding you need on your own terms. From exploring federal loans that don’t consider credit history to looking into specialized lenders like Prodigy Finance, there are various avenues available to help you achieve your financial goals. Remember, preparation and understanding your options are key to mastering this process. Whether you’re financing your education or managing unexpected expenses, take the first step confidently, and pave your way to financial independence. With persistence and resourcefulness, you can overcome the barriers and secure a loan that fits your needs.