In the world of personal finance, the monthly budget stands as a crucial tool for individuals seeking to take control of their financial futures. A well-crafted budget can transform chaos into clarity, providing a roadmap to reach your financial goals, whether it’s saving for a dream vacation, paying off debt, or building an emergency fund. But creating a budget that truly works involves more than just filling in numbers; it requires an understanding of your unique financial landscape and the discipline to stick with it. In this article, we will explore effective strategies and techniques for mastering your finances through a monthly budget that not only reflects reality but also empowers you on your path to financial stability and success.

Understanding the Fundamentals of Budgeting for Financial Success

Understanding the fundamentals of budgeting is crucial for achieving financial success. A well-structured budget acts as a roadmap, guiding you towards your financial goals while ensuring you manage your expenses effectively. Here are some key components to consider:

- Determine Your After-Tax Income: Start by calculating your total income after taxes. This figure will be the foundation of your budget, allowing you to understand how much money you truly have to work with each month.

- Select a Budgeting Method: Choose a budgeting system that works for your lifestyle. Popular methods include the 50/30/20 rule, zero-based budgeting, and envelope system. Each has its strengths depending on your financial habits.

- Track Income and Expenses: Diligently tracking where your money goes is essential. Use apps like Mint or YNAB (You Need A Budget) to help categorize your spending and identify areas where you can cut back.

- Automate Savings: Set up automatic transfers to savings accounts. This ensures you pay yourself first and make building a financial cushion effortless.

- Review and Adjust Regularly: Your budget should not be static. Review it monthly to see if your spending aligns with your financial goals. Adjust as necessary to maintain balance, especially in unexpected situations.

Here’s a simple table to illustrate the 50/30/20 budgeting rule, dividing your income into essential categories:

| Category | Percentage of Income | Example for $3,000 Income |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings and Debt Repayment | 20% | $600 |

Implementing these budgeting fundamentals can significantly improve your financial health. By carefully planning and being mindful of your spending habits, you lay the groundwork for achieving your financial dreams.

Crafting a Realistic Monthly Budget Tailored to Your Lifestyle

Creating a practical monthly budget is essential for achieving your financial goals, whether you’re saving for a vacation, paying down debt, or building an emergency fund. Here’s a straightforward approach to help you tailor a budget that fits your unique lifestyle.

1. Assess Your Income

The first step in crafting your budget is to determine your total monthly income. Include all sources such as:

- Your salary (after tax deductions)

- Side jobs or freelance work

- Investment income

- Any child support or alimony

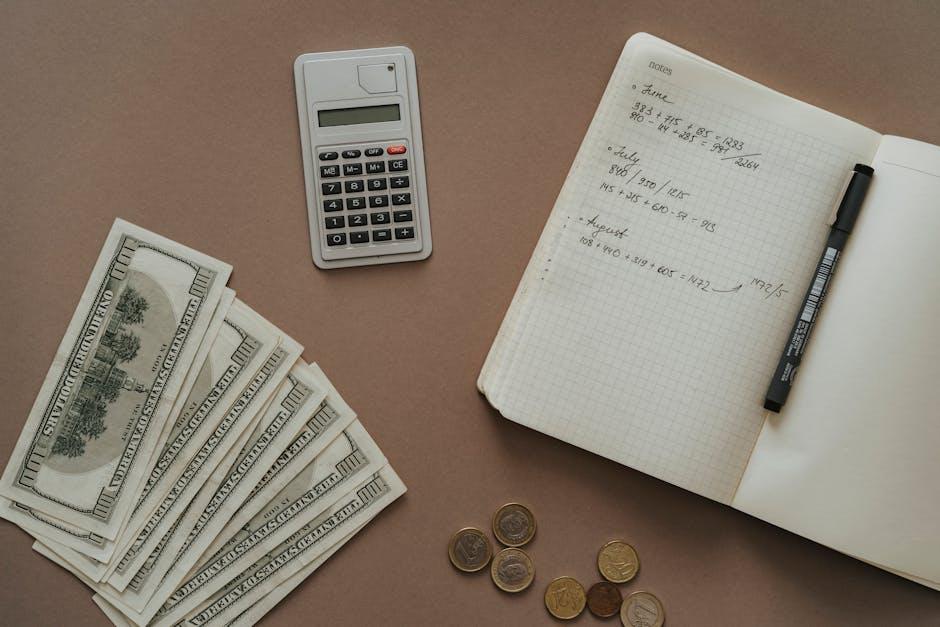

2. Track and Categorize Your Expenses

Next, list out your monthly expenses. Break these down into fixed and variable categories:

- Fixed Expenses: Rent or mortgage, car payments, insurance (health, auto), and student loans.

- Variable Expenses: Groceries, entertainment, dining out, and hobbies.

Use apps like Mint or YNAB (You Need A Budget) to help monitor your spending habits over time. This can provide insights into where you can cut back.

3. Create Your Budget

Now that you have your income and expense categories, create a budget. A popular method is the 50/30/20 rule:

- 50% of your income for needs (essentials like housing and groceries)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Here’s a simple table to visualize this breakdown:

| Category | Percentage | Amount Based on $3,000 Income |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings/Debt Repayment | 20% | $600 |

4. Review and Adjust Your Budget Regularly

Once you’ve set your budget, review it monthly. Life changes-income fluctuations, unexpected expenses, or new goals may require adjustments. Don’t hesitate to modify the categories as necessary.

5. Utilize Financial Tools

Consider using budgeting tools offered by banks such as Chase or Bank of America that provide built-in budgeting features to help you stay on track. Additionally, setting up automatic transfers to savings accounts can make saving easier.

6. Stay Committed

Adhering to a budget isn’t always easy. Make a commitment by setting short-term rewards for yourself, such as a small treat when you stick to your plan for a month. This keeps you motivated and engaged.

Identifying and Prioritizing Essential Expenses for Clarity

To create an effective budget, the first step is identifying and prioritizing your essential expenses. Understanding what constitutes essential spending allows for clarity and ensures you’re focusing on what truly matters in your financial landscape.

Essential expenses are those that you cannot live without. These typically include:

- Housing: Rent or mortgage payments fall under this category. It’s crucial to ensure that your housing costs do not exceed 30% of your monthly income to maintain financial health.

- Utilities: This includes electricity, gas, water, and internet services. Monitoring these can help prevent unexpected spikes in bills.

- Groceries: Basic food and household supplies should be budgeted carefully. Aim for a realistic amount that meets your family’s needs without overspending.

- Healthcare: Consider premiums for health insurance and out-of-pocket costs for medications and doctor visits as critical expenses.

- Transportation: This could mean car payments, insurance, gas, or public transportation costs. Ensure you’re accounting for all potential expenses associated with getting to work or other essential locations.

- Debt Repayment: Prioritizing payments for credit cards, student loans, or any personal loans is vital to avoid late fees and interest accumulation.

Once you’ve listed your essential expenses, the next step is prioritizing these costs. Consider the following strategies:

- Evaluate Necessity: Assign importance to your expenses. Housing and healthcare should top the list, while you might find flexible budget items like subscription services can be adjusted.

- Plan for the Unexpected: Allocate a small portion of your budget for emergency expenses. This could be for car repairs or unexpected medical bills that often arise.

- Review Regularly: Make it a habit to re-evaluate your essential expenses periodically. Changes in your circumstances, such as a new job or relocating, can shift what is considered essential.

| Expense Type | Estimated Monthly Cost |

|---|---|

| Housing | $1,200 |

| Utilities | $200 |

| Groceries | $400 |

| Healthcare | $300 |

| Transportation | $250 |

| Debt Repayment | $350 |

By clearly identifying and prioritizing your essential expenses, you can create a budget that reflects your financial realities. This clarity empowers you to manage your finances more effectively, ensuring you meet your obligations while also making room for savings and future investments.

Staying on Track: Tips for Maintaining Your Budget and Adjusting as Needed

Maintaining a budget can sometimes feel like a daunting task, but with the right strategies, you can stay on track and adjust as needed. Here are some practical tips to help you manage your finances effectively:

- Track Your Spending: Use budgeting apps like Mint or YNAB (You Need A Budget) to monitor your expenses. This helps identify where your money goes and highlights areas for improvement.

- Set Clear Goals: Establish financial goals such as saving for a vacation, paying off debt, or boosting your emergency fund. Clear objectives will motivate you and provide a framework for your spending.

- Regular Reviews: Reassess your budget monthly. This allows you to adjust for any unforeseen expenses or income changes, keeping your budget realistic and achievable.

- Create Categories: Break your budget into categories (e.g., housing, food, entertainment) and allocate funds accordingly. This structure makes it easier to identify where you can cut back if necessary.

- Emergency Fund: Aim to set aside 3-6 months’ worth of living expenses. This provides a financial cushion and prevents budget derailment during unexpected situations.

- Utilize Financial Tools: Take advantage of tools offered by banks, such as automatic savings plans or alerts when you’re nearing your budget limits. Many banks, like Chase and Bank of America, offer online budgeting tools integrated with your accounts.

- Flexibility is Key: Life can be unpredictable. If you find yourself over or under budget in certain areas, reallocate funds as needed. Consider it a living document that should adapt to your lifestyle.

One effective way to visualize your budget adjustments is by using a simple table. Here’s an example of how to categorize and track your spending:

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Housing | $1,200 | $1,150 | $50 |

| Food | $400 | $450 | -$50 |

| Transportation | $300 | $275 | $25 |

| Entertainment | $150 | $200 | -$50 |

With these strategies, you’ll be better equipped to manage your budget and make necessary adjustments. Regularly engaging with your finances not only ensures you meet your goals but also promotes financial literacy and independence.

In Summary

In conclusion, mastering your finances with a monthly budget is not just about tracking numbers; it’s about taking control of your financial destiny. By understanding your income, categorizing your expenses, and making conscious spending choices, you set the stage for achieving your financial goals. Whether you’re saving for a dream vacation or paying off debt, a well-structured budget will pave the way. Remember, the key to success lies in consistency and adaptability-check in on your budget regularly and make adjustments as your circumstances change. Start today, and watch your financial confidence grow as you take charge of your financial future. Your journey to financial freedom begins with a simple step: a budget that works for you.