In today’s financial landscape, understanding your credit health is more crucial than ever. At the center of it all lies your FICO score-a three-digit number that influences everything from loan approvals to interest rates. Whether you’re a first-time borrower or looking to improve your financial standing, mastering your FICO score can pave the way to better credit opportunities. This article will guide you through the essential steps to enhance your score, demystify its components, and empower you to take control of your financial future. Let’s delve into the world of credit scoring and discover how you can achieve better credit health starting today.

Understanding the FICO Score and Its Impact on Your Financial Life

The FICO Score, developed by the Fair Isaac Corporation, is a crucial component in determining your credit health. This three-digit number, ranging from 300 to 850, gives lenders a snapshot of your creditworthiness, which impacts several aspects of your financial life.

Understanding the factors that influence your FICO Score is essential for making informed financial decisions. Here’s a breakdown of how your score is formulated:

| Factor | Percentage of FICO Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Types of Credit in Use | 10% |

| Recent Credit Inquiries | 10% |

Payment history is the most significant factor, where late payments can significantly damage your score. Maintaining on-time payments is crucial for a healthy FICO Score.

Credit utilization refers to the amount of credit you’re using compared to your total available credit. It’s advisable to keep this below 30% to maintain a favorable score. Here are some tips to manage your utilization:

- Pay down existing debts to lower your balance.

- Request a credit limit increase to enhance your total available credit.

- Avoid making large purchases on credit cards.

Length of credit history assesses how long your credit accounts have been active. A longer history typically improves your score, so consider keeping older accounts open, even if you rarely use them.

Types of credit in use include revolving accounts (like credit cards) and installment loans (like auto or mortgage loans). A diverse credit mix can positively influence your score.

Lastly, recent credit inquiries occur when you apply for a new line of credit. While hard inquiries can cause a minor dip in your score, they usually impact it less than other factors. Limiting applications for new credit within a short period can help.

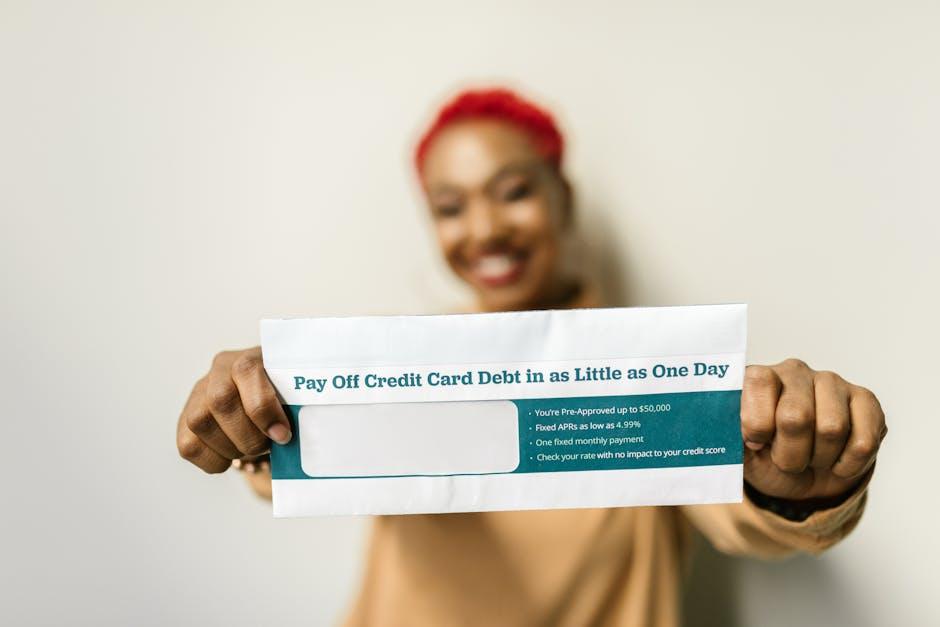

The implications of your FICO Score extend beyond just loan approvals-influencing interest rates, insurance premiums, and even employment opportunities in some cases. A higher score typically means lower interest rates on loans, resulting in considerable savings over time.

Understanding your FICO Score empowers you to take control of your financial journey. Regularly monitoring your credit report will help you stay informed and address any inaccuracies that may arise.

By proactively managing your FICO Score, you can enhance your financial health and unlock better opportunities in your life.

Key Factors That Influence Your FICO Score and How to Optimize Them

Your FICO score is a crucial factor in your financial health, impacting everything from loan approvals to interest rates. Understanding what influences this score can help you make smarter financial decisions. Here are the key elements that determine your FICO score and tips on how to enhance them:

| Factor | Weight (%) | Optimization Tips |

|---|---|---|

| Payment History | 35% |

|

| Credit Utilization | 30% |

|

| Length of Credit History | 15% |

|

| Types of Credit Used | 10% |

|

| New Credit Inquiries | 10% |

|

Monitoring your FICO score regularly can also help identify areas for improvement. Consider using services offered by major providers such as Experian, Equifax, or TransUnion to stay informed. By understanding these factors and optimally managing them, you can take significant steps towards enhancing your credit health.

Effective Strategies for Improving Your FICO Score in the Short and Long Term

Improving your FICO score requires a blend of short-term strategies for quick wins and long-term habits for sustainable success. Here are effective approaches to boost your score:

Short-Term Strategies

If you need to see improvements quickly, consider the following tactics:

- Pay Your Bills on Time: Your payment history makes up 35% of your score. Set up automatic payments or reminders to avoid late fees.

- Reduce Your Credit Utilization: Aim to use less than 30% of your available credit. Pay down existing balances and avoid making large purchases on credit.

- Check Your Credit Report: Review your credit report for errors or inaccuracies. Dispute any mistakes that could be dragging your score down.

- Limit New Credit Inquiries: Each new hard inquiry can temporarily lower your score. Space out applications for new credit to minimize impact.

Long-Term Strategies

Building a robust credit profile takes time and consistent effort. Implement these ongoing practices:

- Keep Old Credit Accounts Open: The length of your credit history accounts for 15% of your score. Keep older accounts active to strengthen this aspect of your score.

- Diversify Your Credit Types: Combining credit cards, installment loans, and retail accounts can demonstrate your ability to manage different types of credit responsibly.

- Establish a Credit Builder Account: These accounts can be particularly beneficial for those with limited credit histories, helping you demonstrate consistent payments.

- Be Smart with New Credit: Only apply for new credit when necessary and ensure that it aligns with your financial goals.

Sample Credit Improvement Plan

| Action Item | Frequency | Expected Outcome |

|---|---|---|

| Check Credit Report | Annually | Identify errors that affect your score |

| Pay Bills on Time | Monthly | Boost payment history component |

| Limit New Applications | As Needed | Reduce hard inquiries impacting score |

| Diversify Credit | As Opportunities Arise | Enhance credit mix for better scoring |

By combining these short-term and long-term strategies, you can establish a solid foundation for improving your FICO score. Consistency is key, so make these practices a regular part of your financial routine.

Monitoring Your Credit Health: Tools and Resources for Continuous Improvement

Monitoring your credit health is crucial for maintaining a favorable FICO score, which can influence everything from loan approvals to insurance premiums. Fortunately, there are several tools and resources available that can help you keep track of your credit standing and help you improve it continuously.

- Credit Monitoring Services: Services like Credit Karma, Experian, and TransUnion offer free or low-cost credit monitoring. They provide regular updates on your credit report, alerts for any new accounts, and changes to your credit score.

- Annual Credit Report: You are entitled to a free credit report each year from the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com. Review these reports carefully for inaccuracies or fraudulent activity.

- FICO Score Estimator: Tools like MyFICO allow you to simulate how different financial behaviors might impact your credit score, giving you insights into how to improve it.

- Financial Apps: Consider mobile apps like Mint or Personal Capital that not only track your spending and budgeting but also include features for monitoring your credit score and alerts for important changes.

- Credit Counseling Services: Organizations like the National Foundation for Credit Counseling (NFCC) provide professional advice and resources to improve your credit standing.

What to Look Out For:

| Focus Area | Why It Matters |

|---|---|

| Payment History | This accounts for 35% of your FICO score. Make payments on time to avoid negative impacts. |

| Credit Utilization | Utilizing less than 30% of your available credit can improve your score. |

| Length of Credit History | A longer history is generally more favorable; keep old accounts open even if you aren’t using them. |

| New Credit Inquiries | Limit the number of hard inquiries when applying for new credit, as too many can indicate risk. |

| Diversity of Credit Types | Having a mix of installment loans and revolving credit can positively impact your score. |

By utilizing these resources and being proactive about your credit health, you can not only manage your FICO score effectively but also set yourself up for a strong financial future.

In Summary

In conclusion, mastering your FICO score is not just a journey; it’s a key that unlocks the door to better financial health. By understanding the factors that influence your score and taking proactive steps to improve it, you pave the way for enhanced credit opportunities, lower interest rates, and greater financial freedom. Remember, knowledge is power. Equip yourself with the tools and strategies discussed in this article, and watch as your credit score transforms into an asset that empowers your financial aspirations. Begin today-your future self will thank you.