In the rapidly evolving landscape of digital finance, pay later options such as ZestMoney and Amazon Pay Later have gained traction, offering users the flexibility to manage their purchases with ease. However, with convenience comes the imperative to evaluate the safety of these financial solutions. As consumers increasingly rely on these platforms for their budgeting and spending, understanding the security measures in place, potential risks, and consumer protections becomes crucial. This article will delve into the safety features, user experiences, and regulatory frameworks surrounding ZestMoney and Amazon Pay Later, providing a comprehensive perspective for anyone considering these innovative payment methods.

Evaluating Risk Factors in ZestMoney and Amazon Pay Later Financing

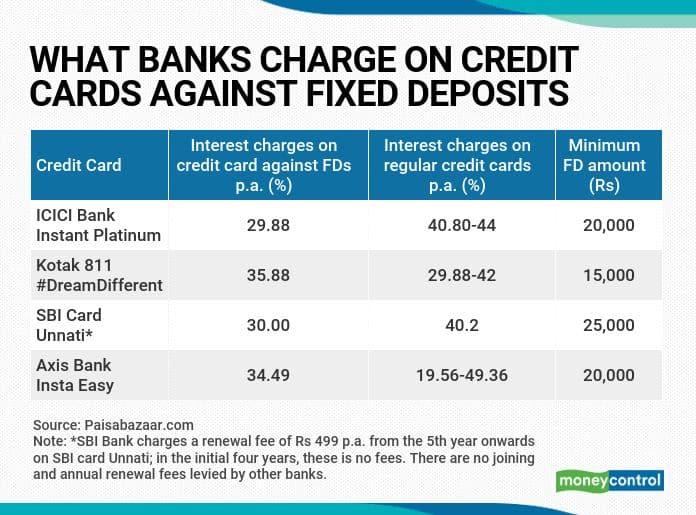

When assessing the risk factors associated with ZestMoney and Amazon Pay Later, several critical elements come into play. Users must consider the potential for high-credit-cards-through-fixed-deposits-without-income/” title=”Unlocking … Cards Through Fixed Deposits Without Income”>interest rates that can accumulate if payments are missed, leading to significant financial stress. Additionally, the ease of access to credit may tempt consumers to make purchases beyond their means. Therefore, it is essential to evaluate one’s repayment capacity before opting into these financing solutions.

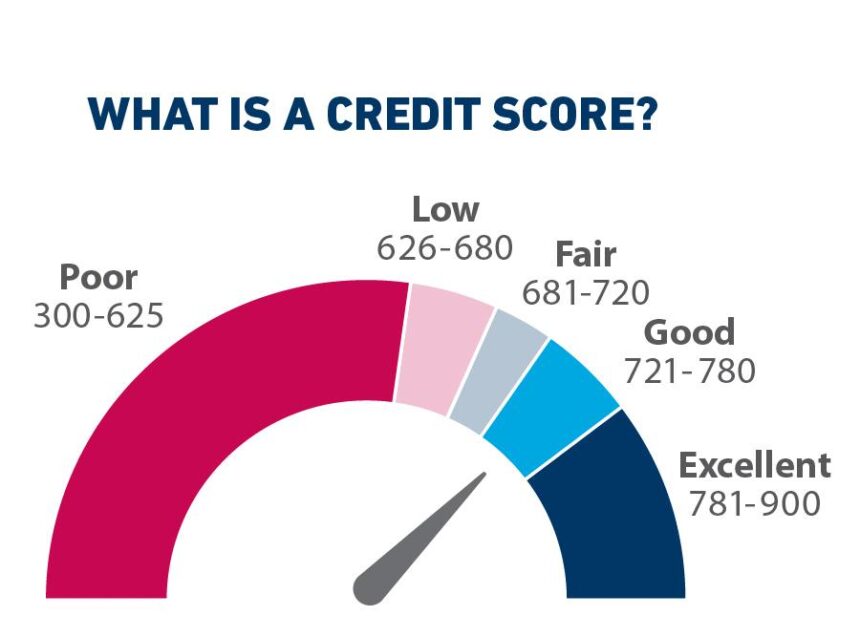

Another factor to take into account is the impact on credit scores. Both platforms may report borrowing activity to credit bureaus, which could affect a user’s creditworthiness if payments are not managed effectively. Understanding the terms and conditions of each service is crucial, as they often include hidden fees or penalties that can exacerbate the financial burden. To simplify these evaluations, consider using the table below to summarize key risk elements:

| Risk Factor | ZestMoney | Amazon Pay Later |

|---|---|---|

| Interest Rates | Variable rates may apply | Potential late fees if payment is missed |

| Credit Score Impact | Reported to bureaus | May affect credit report |

| Repayment Flexibility | Options available | Limited flexibility |

| Hidden Fees | Possible | Varies by transaction |

Understanding Consumer Protections and Regulations

Consumer protections play a crucial role in maintaining the integrity and safety of financial products like ZestMoney and Amazon Pay Later options. Regulations govern these platforms to ensure they operate transparently and fairly, providing consumers with essential disclosures regarding interest rates, fees, and repayment terms. Key points to consider include:

- Clear Terms and Conditions: Consumers must have access to straightforward and comprehensible information.

- Disclosure of Fees: Platforms should transparently inform users about any associated costs or extra charges.

- Fair Lending Practices: Regulations aim to prevent predatory lending, ensuring that consumers are not misled into taking on more debt than they can afford.

Moreover, regulatory bodies actively monitor these services to protect consumers from fraudulent activities and misuse of data. This oversight helps in establishing secure transaction environments and promotes consumer confidence. Important regulatory aspects include:

- Privacy Protection: Safeguarding customers’ personal and financial information.

- Complaint Handling Mechanisms: Ensuring users can report issues and receive timely resolutions.

- Consumer Education: Providing resources to help consumers make informed decisions about their financial partnerships.

| Criteria | ZestMoney | Amazon Pay Later |

|---|---|---|

| Interest Rates | Variable rates based on credit score | Fixed rates available through promotions |

| Repayment Options | Flexible installment plans | Easy EMI options |

| Consumer Support | 24/7 customer service | Support via Amazon Help |

Assessing Fraud Prevention Measures and Security Protocols

In the rapidly evolving landscape of digital finance, it is crucial for platforms like ZestMoney and Amazon Pay Later to implement robust fraud prevention measures. These platforms utilize a combination of advanced technologies and strategic protocols to mitigate potential risks. By employing data analytics and machine learning algorithms, they can identify and analyze suspicious patterns in user behavior that may indicate fraudulent activity. Key features include:

- Real-Time Monitoring: Continuous assessment of transactions helps in the immediate detection of anomalies.

- Multi-Factor Authentication: Ensures that users are verified through multiple channels before any transaction is approved.

- User Education: Promoting awareness among users about potential frauds and safe online practices bolsters overall security.

Furthermore, enhancing security protocols involves regular updates to the systems that underpin these platforms. This commitment to proactive security measures not only protects the financial interests of users but also helps in building trust. Both ZestMoney and Amazon Pay Later have implemented comprehensive protocols including:

| Security Measure | Description |

|---|---|

| Encryption | Data is secured through encryption methods, making it unreadable to unauthorized users. |

| Fraud Detection Systems | Algorithms that flag potentially fraudulent transactions based on historical data. |

Making Informed Choices: Tips for Safe Use of Buy Now Pay Later Services

When considering options like ZestMoney and Amazon Pay Later, it’s crucial to evaluate their safety features and terms carefully. Start by reviewing the interest rates and repayment schedules they offer. Some services might advertise zero interest but could include hidden fees that accumulate if payments are late. Always read the fine print and ask yourself:

- Are the terms clear and transparent?

- What happens if I miss a payment?

- Are there penalties or fees that could add up?

Additionally, ensure that any service you choose employs robust security measures to protect your personal and financial information. Look for secure payment gateways and check if they are compliant with regulations. A quick research could include:

| Service | Security Features | Customer Support |

|---|---|---|

| ZestMoney | Encryption & Two-factor authentication | 24/7 support |

| Amazon Pay Later | Fraud protection & Verified by Visa | Comprehensive FAQs |

Make an informed decision by weighing the pros and cons of each service and ensuring you understand the implications of your financing choices.

Concluding Remarks

In conclusion, as the landscape of digital financing continues to evolve, both ZestMoney and Amazon Pay Later present unique advantages and considerations for consumers seeking flexible payment options. By meticulously evaluating the safety measures, interest rates, and user experiences associated with each platform, users can make informed decisions that align with their financial needs. Ultimately, the choice between these services should rest on an individual’s confidence in the technology, their understanding of personal financial health, and an awareness of the potential risks involved. As we venture into the future of digital payments, being a discerning consumer has never been more crucial. Stay informed, stay safe, and make the most of the conveniences offered by modern financial solutions.