In an era defined by rapid technological advancements and shifting economic landscapes, Generation Z stands at the forefront of a new financial frontier. With a world brimming with opportunities and challenges, savvy financial management has never been more crucial. This article explores innovative strategies and practical financial hacks designed to empower Gen Z. By demystifying budgeting, investing, and saving techniques, we aim to equip young individuals with the tools necessary to navigate their financial journeys confidently and carve out a prosperous future. Join us as we unveil the essential financial wisdom that can turn aspirations into realities.

Unleashing the Power of Budgeting: Crafting Your Financial Roadmap

Mastering the art of budgeting can transform your financial future. Begin by crafting a budget that illuminates your income and expenses, serving as your financial blueprint. Identify your fixed costs, such as rent and utilities, alongside variable expenditures, which can include groceries, entertainment, and dining out. By clearly outlining these categories, you can better control your spending and allocate funds toward savings and investment opportunities.

Utilizing budgeting tools can further streamline this process, making it easier to track your progress and adjust as necessary. Explore apps that sync with your accounts to help you monitor your spending habits in real-time. Set clear goals for savings and debt repayment, ensuring your budget reflects your aspirations for the future. Here’s a simple breakdown of financial priorities:

| Priority | Action |

|---|---|

| Emergency Fund | Save at least 3-6 months of expenses. |

| Debt Management | Focus on paying off high-interest loans first. |

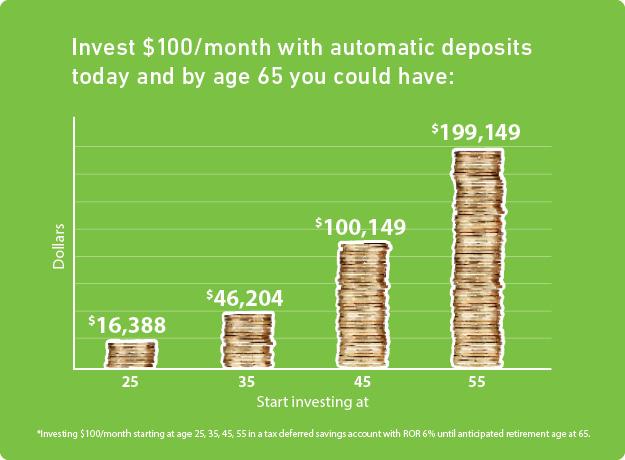

| Investments | Start a retirement account early to benefit from compound interest. |

Smart Investment Strategies for the Next Generation

As the financial landscape evolves, younger investors must adopt strategies that align with their unique goals and values. Among these, dollar-cost averaging stands out as a method that mitigates the risks of market volatility. By investing a fixed amount regularly, Gen Z can take advantage of market dips without trying to time the market. This strategy not only encourages consistent investment habits but also helps in accumulating more shares when prices are low, enhancing long-term returns. Emphasizing sustainable investing is another essential strategy, as many younger investors prioritize companies that demonstrate social and environmental responsibility.

Furthermore, growth and momentum investing can provide opportunities for quick gains in a rapidly changing market. Starting with a solid understanding of fundamental analysis, focusing on companies with strong growth potential is vital. Many platforms now offer user-friendly interfaces and educational resources, making it easier than ever for novice investors to research. To visualize potential outcomes, the following table summarizes some key investment strategies:

| Strategy | Description | Best For |

|---|---|---|

| Dollar-Cost Averaging | Investing a fixed sum regularly | Risk-averse investors |

| Growth Investing | Focusing on companies with high growth potential | Long-term gains |

| Momentum Investing | Capitalizing on market trends | Short-term gains |

| Sustainable Investing | Investing in socially responsible companies | Ethical investors |

Harnessing Digital Tools: Apps and Resources That Make a Difference

In today’s digital age, Gen Z has unparalleled access to a variety of financial tools that empower them to take control of their financial futures. Leveraging budgeting apps can help track expenses and set financial goals. Consider using popular platforms like:

- Mint: Automatically syncs bank accounts and monitors spending habits.

- YNAB (You Need A Budget): Promotes proactive budgeting to help users prioritize savings.

- PocketGuard: Offers a clear view of available spending after bills and savings are accounted for.

Moreover, investing apps are reshaping how young investors enter the market. With user-friendly interfaces, these apps lower the barrier for participation in stock trading. Valuable resources like:

- Acorns: Rounds up purchases to the nearest dollar and invests spare change.

- Robinhood: Allows commission-free trading and easy access to market data.

- Webull: Offers advanced features for experienced investors with no minimum balance.

Building a Strong Credit Foundation: Steps to Secure Your Financial Future

Creating a robust credit foundation is essential for financial health, especially for Gen Z starting their journey. Begin by checking your credit report regularly to monitor your scores and identify any inaccuracies. You can obtain a free report annually from each of the major credit bureaus. Make it a habit to set up bill payments on time, as payment history significantly influences your credit score. Additionally, consider using a secured credit card to build positive credit history, allowing you to manage your expenditures while demonstrating responsible credit use.

Another crucial step is to limit credit inquiries. When searching for new credit, do so sparingly to avoid negatively impacting your score through multiple hard inquiries. Establishing a mix of credit types (such as revolving credit and installment loans) can also enhance your credit profile. Lastly, aim to maintain your credit utilization below 30% of your total available credit, which shows lenders you can manage and repay debts responsibly. Following these steps can significantly strengthen your credit standing and secure your financial future.

To Wrap It Up

In a world rich with opportunities and challenges, Generation Z stands at the forefront of a financial revolution. By harnessing the savvy financial hacks we’ve explored, young individuals can equip themselves with the tools necessary for a brighter and more secure future. From budgeting wisely and understanding investments to embracing digital currencies, each step taken today lays the groundwork for tomorrow’s success. As you navigate this journey, remember: financial empowerment isn’t just about making money-it’s about making informed choices that align with your values and goals. Here’s to embracing a future where financial freedom is not just a dream, but a vividly attainable reality.