In your 30s, the financial landscape can feel both exciting and daunting. It’s a decade often marked by career advancements, new family dynamics, and homeownership ambitions. However, amidst these developments, many individuals find themselves navigating a minefield of financial missteps that can jeopardize their long-term stability. From the seductive allure of lifestyle inflation to the consequences of neglecting retirement savings, common saving snafus can derail even the most promising financial paths. Understanding these pitfalls now can empower you to make informed decisions and secure a more prosperous future. Join us as we explore the key financial traps to avoid in your 30s, ensuring your savings set the stage for lasting success.

Navigating Lifestyle Inflation and Its Impact on Savings

As you navigate your 30s, the allure of lifestyle inflation can subtly creep into your financial landscape, making it easy to overlook its effects on your savings. Often, this phenomenon unfolds when income increases lead to an upgrade in living standards, yet it rarely results in a proportional increase in savings. To combat this, consider adopting a mindful approach to spending that prioritizes necessities over luxuries. Strategies such as maintaining a clear budget, setting savings goals, and regularly tracking expenditures can provide the necessary discipline to resist unnecessary upgrades.

Additionally, it’s crucial to recognize the often tempting tendencies that accompany lifestyle inflation. Here are some key areas where one might feel pressured to overspend:

- Housing: Upgrading to a larger home or a more luxurious apartment.

- Transportation: Opting for new cars or premium models instead of reliable used vehicles.

- Dining Out: Frequent fine dining experiences instead of cooking at home.

Creating a plan to prioritize long-term financial health over short-term gratification is essential. Establishing an automatic savings plan can help you build a robust safety net while enjoying a fulfilling lifestyle without compromising your financial future.

Understanding the Hidden Costs of Parenthood and How to Prepare

When stepping into the world of parenthood, it’s crucial to think beyond the obvious expenses like diapers and daycare. Hidden costs often lurk in places you might not consider, catching new parents off guard. From increased utility bills due to extra laundry and heating to unexpected medical expenses, these financial pitfalls can quickly accumulate. To effectively manage your budget, it’s wise to create an extensive list of potential hidden costs, which may include:

- Childcare expenses: Not just monthly fees, but also last-minute care when plans change.

- Food expenses: Increased grocery bills as you introduce new foods for your child.

- Clothing and gear: Babies grow fast, and the need for new clothes can be relentless.

- Health care: Routine check-ups and unexpected doctor visits add up.

To prepare effectively, consider setting up a savings account specifically for these hidden costs. An organized approach can help buffer the financial strain. Review your monthly budget to determine feasible contributions to this fund, ensuring it aligns with both your short-term and long-term financial goals. You can even create a simple table to track these contributions, adjusting as necessary based on your family’s evolving needs:

| Month | Savings Goal | Contributions |

|---|---|---|

| January | $200 | $50 |

| February | $200 | $60 |

| March | $200 | $70 |

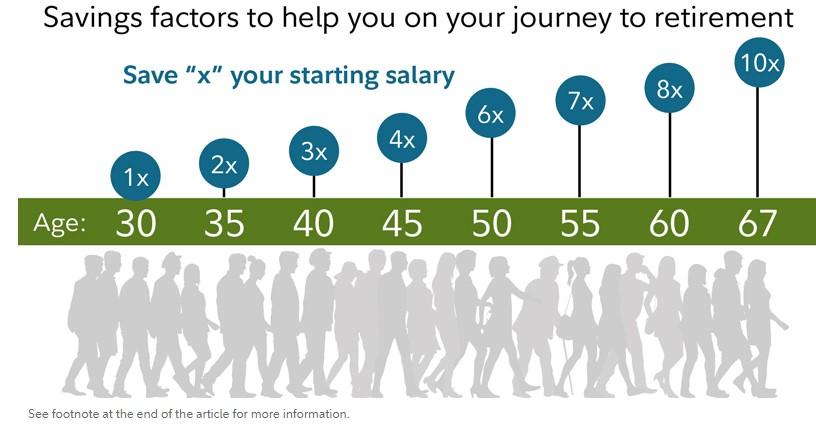

The Dangers of Ignoring Retirement Planning Early On

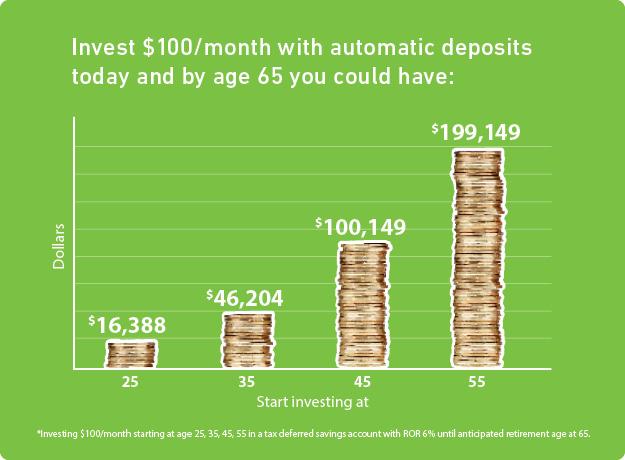

Failure to prioritize retirement planning in your 30s can lead to significant financial consequences. Many individuals believe they have ample time to save, resulting in delays that can create a widening gap in their retirement savings. Consider the following pitfalls:

- Delayed Contributions: Low initial savings can compound into substantial losses over time.

- Underestimating Expenses: Ignoring future living costs can derail your financial goals.

- Lack of Investment Knowledge: Not understanding investment options may limit growth potential.

Moreover, neglecting to develop a solid financial strategy can leave your future self without crucial resources. Early planning facilitates better decisions regarding savings vehicles and risk management. Key considerations include:

- Employer Matches: Don’t leave free money on the table by missing out on company retirement contributions.

- Compound Interest Benefits: Starting early enhances the power of interest over time, increasing your savings significantly.

- Future Lifestyle Aspirations: Define your retirement vision to tailor your savings plan accordingly.

Building a Sustainable Budget: Strategies for Long-Term Success

Creating a budget that stands the test of time requires a proactive approach, especially when you’re in your 30s, navigating through various life changes. Start by identifying your fixed expenses such as rent or mortgage, utilities, and insurance. Next, allocate funds to variable expenses like groceries, entertainment, and personal care. Here’s a smart way to balance your spending:

- Track Every Penny: Use apps or spreadsheets to monitor your spending habits.

- Emergency Fund: Aim to save 3-6 months’ worth of expenses to cushion against unexpected events.

- Create Savings Goals: Whether for a vacation or a new car, define what you’re saving for and how much you need.

It’s also essential to reconsider unnecessary subscriptions and impulse purchases that can derail your financial wellness. To visualize your budget’s effectiveness, consider evaluating a simple table that outlines income vs. expenses:

| Category | Income ($) | Expenses ($) |

|---|---|---|

| Monthly Income | 4000 | – |

| Fixed Expenses | – | 2000 |

| Variable Expenses | – | 1500 |

| Savings | – | 500 |

By regularly reviewing and adjusting these figures, you can cultivate a sustainable budget that not only meets your immediate needs but also supports long-term financial aspirations.

In Retrospect

As you navigate the intricate landscape of your 30s, it’s crucial to arm yourself with knowledge about the potential financial pitfalls that can derail your savings ambitions. By staying informed and making deliberate choices, you can sidestep these snafus and build a solid foundation for your financial future. Remember, the journey to financial well-being is a marathon, not a sprint. With thoughtful planning and the right strategies, you can turn your aspirations into achievable realities. So, take a moment to reflect on your financial goals, keep a watchful eye on your habits, and don’t hesitate to seek guidance when needed. The path to prosperity begins with informed decisions today, ensuring a more secure tomorrow.