In the ever-evolving landscape of financial planning, selecting the right insurance product is a pivotal decision that can greatly impact one’s future security. As we venture into 2025, individuals are presented with a myriad of options, two of the most prominent being LIC Jeevan Labh and Term Insurance. Each of these products offers unique benefits tailored to different needs and life stages, making the choice both crucial and complex. While LIC Jeevan Labh combines life coverage with savings, ensuring a financial cushion for the policyholder’s loved ones, Term Insurance provides straightforward protection against unforeseen circumstances, often at a lower premium. This article will delve into the fundamental characteristics, advantages, and considerations of both options, equipping you with the knowledge to make an informed choice that aligns with your financial goals and peace of mind.

Evaluating Financial Security: A Comparison of LIC Jeevan Labh and Term Insurance

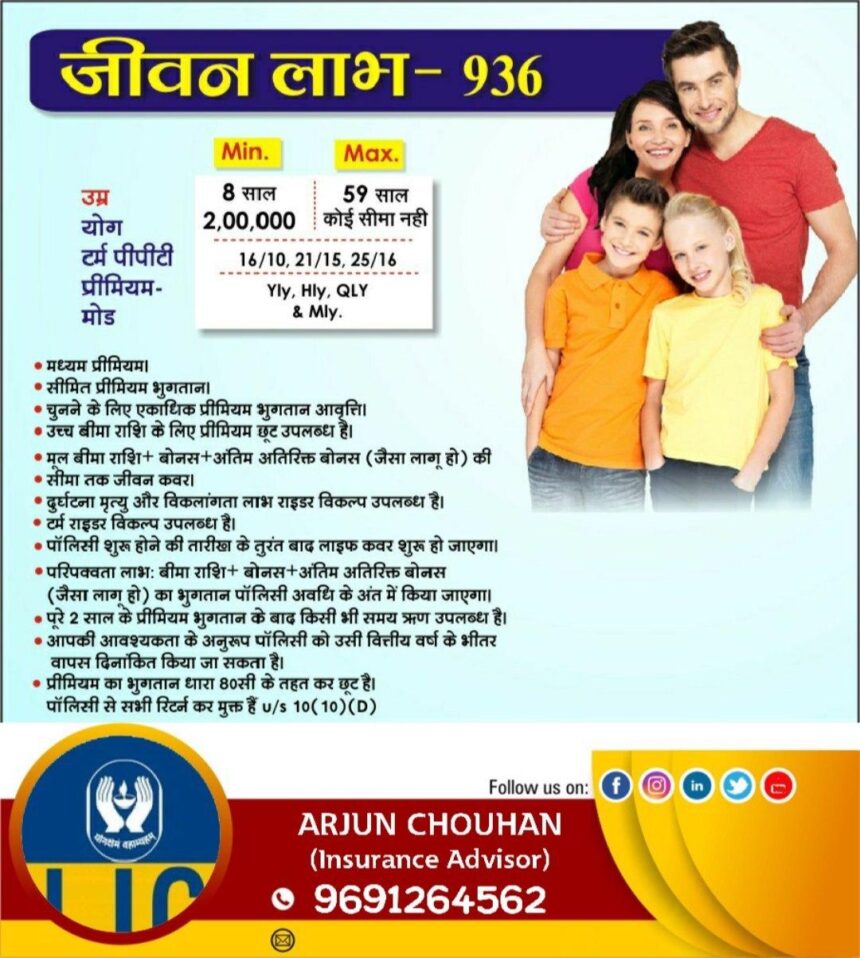

When comparing LIC Jeevan Labh and Term Insurance, it’s essential to understand their distinct features and benefits. LIC Jeevan Labh is a limited premium paying endowment plan that offers both protection and savings. This policy provides a lump sum amount on maturity or in case of unfortunate events, making it suitable for those who want to secure their family’s future while also building a corpus. It combines insurance with investment, allowing policyholders to enjoy a dual advantage. The key benefits include:

- Maturity Benefit: Sum Assured plus bonuses payable on maturity.

- Death Benefit: Financial protection for dependents in the event of the policyholder’s death.

- Pension Option: Flexibility to opt for a pension plan at maturity.

On the other hand, Term Insurance is often viewed as a pure protection plan. It provides a substantial death benefit to the beneficiaries but does not offer any maturity benefit, making it an affordable option for many. This type of insurance is ideal for individuals seeking high coverage at lower premiums. Key features of Term Insurance include:

- High Coverage: Offers a large sum insured at an economical cost.

- Flexible Terms: Various term durations to fit individual needs.

- No Maturity Benefit: Concentrated solely on providing financial security at death.

Understanding Policy Features: Coverage, Benefits, and Flexibility

When considering LIC Jeevan Labh versus term insurance, understanding the distinct policy features is crucial for making an informed choice. LIC Jeevan Labh offers a combination of life coverage and savings component, allowing policyholders to build a corpus over time. Key benefits include:

- Death Benefit: Financial security for beneficiaries.

- Maturity Benefit: Sum assured along with bonuses at the end of the policy term.

- Flexible Premium Payment Options: Choose between regular, limited, or single premium payment modes.

In contrast, term insurance is primarily focused on providing a substantial death benefit without the frills of a savings plan. It’s known for its affordability and straightforward nature. Benefits of choosing term insurance include:

- High Coverage Amount: Offers larger sums assured at lower premiums.

- Simple Structure: No maturity payout; purely a safety net for dependents.

- Convertible Options: Some policies allow for conversion to whole or term plans without additional health checks.

| Feature | LIC Jeevan Labh | Term Insurance |

|---|---|---|

| Coverage Type | Life + Savings | Life Only |

| Premium Cost | Higher | Lower |

| Death Benefit | Yes | Yes |

| Maturity Benefit | Yes | No |

Cost Considerations: Premiums and Long-Term Financial Implications

When evaluating LIC Jeevan Labh and term insurance, understanding the premium structure is crucial for making an informed decision. While LIC Jeevan Labh offers a combination of insurance and investment, typically resulting in higher premiums, term insurance provides pure coverage at a lower cost. This difference leads to varied financial implications, particularly in long-term planning. Consider the following key aspects:

- Premium Amount: Term insurance generally features lower premiums compared to LIC Jeevan Labh.

- Potential Returns: LIC Jeevan Labh can yield returns on maturity, impacting long-term savings.

- Coverage Duration: Term insurance is often available for a specific duration, affecting ongoing financial commitments.

Moreover, the impact on your financial stability over time cannot be overstated. With LIC Jeevan Labh, the element of savings might make it appealing for those wanting to secure future financial goals. In contrast, the low premium of term insurance could allow for greater allocation towards investment vehicles, potentially yielding higher returns. Below is a simple table summarizing the differences:

| Feature | LIC Jeevan Labh | Term Insurance |

|---|---|---|

| Premium Cost | Higher | Lower |

| Maturity Benefit | Yes | No |

| Investment Component | Yes | No |

| Coverage Period | Flexible | Fixed |

Making the Right Choice: Tailoring Insurance to Your Life Stage and Goals

Choosing the right insurance plan can significantly impact your financial future, especially as your life circumstances evolve. When considering LIC Jeevan Labh versus Term Insurance, it’s essential to align your choice with your life stage and long-term objectives. For younger individuals, who may prioritize affordability and straightforward coverage, term insurance offers a pure protection plan with no investment component, making it an ideal choice for those looking to cover immediate financial responsibilities, such as home loans or family support. In contrast, LIC Jeevan Labh, being a limited premium paying endowment plan, combines both insurance and savings, appealing to those who value a dual benefit over time.

As you progress through various life stages, your insurance needs will likely change. For example, newly married couples might seek Term Insurance for its high coverage at a lower cost, while parents could appreciate the savings aspect of LIC Jeevan Labh as it not only provides life cover but also serves as a financial tool for future expenses like children’s education or marriage. Consider the following factors when deciding:

- Current Needs: Assess your financial obligations.

- Future Goals: Think about savings and investment aspirations.

- Premium Affordability: Analyze what fits within your budget.

- Flexibility: Determine how easily you can adjust your policy.

In Conclusion

As we navigate through the complexities of financial planning in 2025, the decision between LIC Jeevan Labh and term insurance becomes increasingly significant. Both options cater to different needs and priorities, offering unique benefits that can align with our personal and financial goals. While LIC Jeevan Labh provides a blend of investment and protection, term insurance stands as a robust safety net for your loved ones.

Ultimately, the choice hinges on individual circumstances, risk tolerance, and future aspirations. Taking the time to assess your financial landscape and consider both products carefully can pave the way for more secure tomorrows. Whether you prioritize investment growth or pure protection, both paths can lead to peace of mind and financial stability. Embrace this decision as an opportunity to shape a brighter future for you and your family.