In today’s fast-paced financial landscape, navigating the complexities of credit card interest rates can feel like walking a tightrope. With annual percentage rates (APRs) climbing higher, understanding how to avoid getting trapped in a cycle of debt is crucial for your financial well-being. Whether you’re a seasoned credit card user or just beginning to explore your options, mastering the strategies to dodge high APRs can empower you to take control of your finances. In this article, we will unveil essential tips and practical advice to help you make informed decisions and keep your costs manageable, ensuring that your credit experience remains a useful tool rather than a burdensome hitch.

Understanding APR and Its Impact on Your Finances

APR, or Annual Percentage Rate, is a crucial concept in personal finance that can significantly influence your financial health, especially when it comes to credit cards. Understanding how APR works and its implications can help you make informed decisions and avoid costly mistakes.

The APR on your credit card indicates the cost of borrowing expressed as a yearly interest rate. It encompasses not just the interest on the credit amount borrowed but may also include certain fees. Here’s what you need to consider:

- Types of APR: There are several types of APRs to be aware of:

- Fixed APR: Interest rates that remain constant throughout the life of the loan.

- Variable APR: Rates that can fluctuate based on economic indices-typically linked to the Prime Rate.

- Introductory APR: A lower promotional rate offered for a limited time before reverting to a higher standard rate.

When evaluating credit cards, consider the following factors that can help you manage or lower your APR:

- Credit Score: A higher credit score can qualify you for lower APRs. Regularly check your score and work to improve it by paying bills on time and keeping debt levels low.

- Shop Around: Different credit card issuers offer varying APRs. Compare APRs across cards, especially focusing on those that provide rewards or cash back without high-interest rates.

- Understand Your Billing Cycle: Knowing the timing of your billing cycle can help you avoid late fees and additional interest charges.

Here’s a simple way to visualize how APR affects your finances:

| APR | Monthly Payment on $1,000 Balance | Total Interest Paid Over 5 Years |

|---|---|---|

| 15% | $23.57 | $414.20 |

| 20% | $25.88 | $577.67 |

| 25% | $28.32 | $746.43 |

As seen in the table above, even a small increase in APR can lead to significantly higher payments and interest costs over time. This is why choosing a credit card with a lower APR will benefit your long-term financial strategy.

Key Takeaways:

- Understanding your credit card’s APR is crucial for effective financial management.

- A higher credit score can qualify you for lower rates.

- Regular monitoring of APR options can save money in the long run.

Strategic Timing for Credit Card Applications

Timing your credit card application can significantly influence your chances of approval and the interest rates you receive. Here are some key considerations to help you navigate the application process strategically:

- Assess Your Credit Score: Before applying, check your credit score. Scores typically range from 300 to 850, and a score above 670 is generally considered good. A higher score can improve your chances of receiving lower APR offers.

- Evaluate Your Credit History: A lengthy credit history with on-time payments and low credit utilization boosts your creditworthiness. If you’re just starting out or your history is short, you might want to delay your application until you can strengthen it.

- Monitor Timing Between Applications: Each credit card application triggers a hard inquiry, which may lower your score temporarily. It’s advisable to wait at least six months between applications to minimize the impact on your score and to show potential lenders that you are financially responsible.

- Plan Around Major Purchases: If you’re planning a significant purchase, consider applying for a credit card just before that purchase. Some cards offer introductory 0% APR periods that can save you money on interest during large transactions.

- Consider Seasonal Offers: Banks often release special promotions around the holidays or during major shopping events. Keep an eye on these offers, as they can include benefits like cash back or bonus rewards, further lowering the effective APR.

| Timing Strategy | Benefits |

|---|---|

| Apply after checking and improving credit score | Higher chances of approval and better rates |

| Wait 6 months between applications | Minimized impact on credit score |

| Time applications before large purchases | Access to 0% APR introductory offers |

| Watch for seasonal promotions | Enhanced rewards can offset costs |

By strategically timing your credit card applications, you can improve your approval odds and secure lower interest rates, keeping your financial health in check.

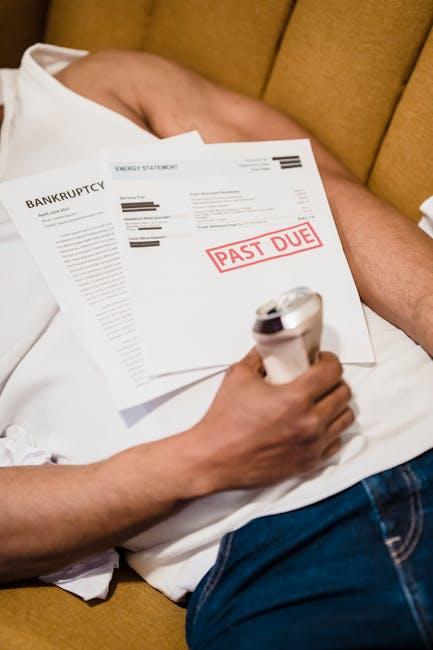

Effective Techniques to Manage and Reduce Debt

Managing and reducing debt can seem daunting, but with the right techniques, you can regain control of your financial situation. Here are some effective strategies that can help you navigate out of debt:

- Create a Budget: Start by tracking your income and expenses. Allocate a portion specifically for debt repayment. Use tools like Mint or YNAB (You Need a Budget) to simplify this process.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first. This method, known as the avalanche method, minimizes overall interest paid.

- Consider Debt Snowballing: Alternatively, you could use the debt snowball method, which involves paying off the smallest debts first. This can help build momentum as you tackle larger debts.

- Negotiate Lower Interest Rates: Call your credit card issuer and ask for a lower rate. Many companies have programs for dedicated customers, especially those with timely payments.

- Consolidate Your Debt: Look into debt consolidation loans. Banks like Discover or credit unions often offer personal loans with lower interest rates to help pay off credit card debt.

- Automate Payments: Set up automatic payments for your debts. This ensures you never miss a payment and helps avoid late fees, which can add to your debt burden.

- Cut Unnecessary Expenses: Review your expenses and identify areas where you can cut back. Redirect these savings towards paying down your debts.

- Seek Professional Help: If your debt feels overwhelming, consider working with a credit counseling service. They can assist you in creating a manageable repayment plan and offer valuable advice.

| Debt Reduction Techniques | Advantages |

|---|---|

| Budgeting | Improves financial awareness and control. |

| Debt Avalanche | Saves the most money on interest. |

| Debt Snowball | Boosts motivation with quick wins. |

| Interest Rate Negotiation | Lower monthly payments and total interest. |

| Consolidation | Simplifies payments into one low monthly bill. |

| Automated Payments | Prevents late fees and missed payments. |

| Cutting Expenses | Increases cash flow for debt repayment. |

| Professional Counseling | Offers expert guidance and support. |

By implementing these techniques, you can effectively manage and reduce your debt, allowing you to focus on building a healthier financial future.

Leveraging Rewards and Benefits Without Compromise

Making the most out of your credit card rewards can significantly reduce the financial impact of higher APRs. By choosing the right card and leveraging its perks, you can enjoy benefits without sacrificing your financial wellbeing. Here’s how to do it effectively:

- Choose Cards with No Annual Fees: Many credit cards offer rewarding programs without charging an annual fee. Explore options that provide cash back or points on everyday purchases, such as groceries and gas, without additional costs.

- Maximize Sign-Up Bonuses: Sign-up bonuses can jumpstart your rewards journey. Look for cards that offer substantial bonuses if you meet a minimum spending requirement within the first few months. This initial boost can help offset any potential fees while you earn rewards.

- Utilize Rotating Categories: Some credit cards offer higher rewards percentages on specific categories that change quarterly. If you align your spending with these categories, you can maximize your cash back or points. For example, the Chase Freedom Unlimited® often provides increased rewards for dining and travel during certain months.

- Combine Rewards with Other Accounts: Opt for banks that allow you to combine rewards across different accounts. For instance, some banks provide enhanced benefits if you have a mortgage or savings account with them, allowing you to leverage your entire financial portfolio for better rewards.

- Pay Off Balances Monthly: To dodge high APRs, always aim to pay off your credit card balances in full each month. This practice eliminates interest charges and keeps your rewards purely as benefits rather than accruing debt.

| Credit Card | Rewards Type | Annual Fee | Sign-Up Bonus |

|---|---|---|---|

| Chase Freedom Unlimited® | Cash Back | $0 | $200 after spending $500 in the first 3 months |

| Capital One Savor Cash Rewards | Cash Back | $95 (waived first year) | $300 after spending $3,000 in the first 3 months |

| Discover it® Cash Back | Cash Back | $0 | Match all cash back earned at the end of your first year |

When considering rewards cards, review the fine print and understand how the rewards system works. Look for competitive cash-back percentages, especially for your regular spending categories. With a bit of strategy and awareness, you can leverage these rewards to not only benefit your financial situation but also enjoy perks without the burden of high-interest debt.

The Conclusion

As we wrap up our exploration of strategies to sidestep high APRs on credit cards, remember that knowledge is your most powerful ally. By understanding the intricacies of interest rates, diligently managing your payments, and seeking alternatives, you can take control of your financial landscape. The tools are at your disposal; now it’s up to you to wield them wisely. Stay vigilant, keep learning, and empower yourself to make informed decisions that benefit your financial future. With these master tips in hand, you’re well-equipped to navigate the credit card world and avoid those pesky high APR traps. Safe travels on your financial journey!