In an era where credit cards can offer convenience and flexibility, they also pose a significant challenge for many Americans-debt. As the cost of living rises and unexpected expenses arise, the balance on credit cards can quickly escalate, leading to stress and financial strain. However, there are effective strategies to tackle credit card debt head-on. This article delves into actionable and quick methods to help you regain control of your finances and pave the way to a debt-free future. Whether you’re overwhelmed by multiple balances or simply looking to optimize your payments, these strategies are designed to fit into the busy lives we lead today, empowering you to make progress without feeling overwhelmed.

Understanding the Impact of High-Interest Rates on Credit Card Debt

High-interest rates can significantly impact credit card debt, making it crucial for consumers to understand how these rates affect their finances. In the U.S., credit card interest rates can often reach upwards of 20%, leading to a cycle of debt that’s challenging to escape. Here’s what you need to know:

- Interest Accumulation: When you carry a balance on your credit card, interest compounds daily. This means that the longer you take to pay off your balance, the more you will owe.

- Minimum Payments: Paying only the minimum due can result in a prolonged repayment period. For instance, if your balance is $5,000 with a 20% APR and you only pay the minimum, it could take over 20 years to pay off.

- Total Cost of Debt: With high-interest rates, the total cost of borrowing can escalate quickly. Over time, you may pay several times the original amount borrowed just in interest.

- Credit Score Implications: High balances relative to your credit limit can negatively impact your credit score. A low score can further increase the interest rates you are offered.

To illustrate the impact, consider the following table that compares two scenarios of credit card repayment at different interest rates:

| Balance | Interest Rate | Minimum Payment | Time to Pay Off (months) | Total Interest Paid |

|---|---|---|---|---|

| $5,000 | 15% | $150 | 42 | $1,544 |

| $5,000 | 20% | $150 | 60 | $2,004 |

As seen in the table, a higher interest rate not only increases the total interest paid but also extends the time required to clear the debt. It’s evident that managing credit card debt effectively requires vigilance over interest rates, payment strategies, and regular budgeting.

To mitigate these impacts, consumers should consider options such as:

- Balance Transfers: Moving debt from a high-interest card to one with a lower rate or introductory 0% APR can provide temporary relief.

- Debt Snowball Method: Focus on paying off the smallest debts first while making minimum payments on larger debts to build momentum.

- Negotiating Rates: Sometimes, simply calling your credit card issuer can result in reduced interest rates, especially for long-time customers.

Understanding the dynamics of high-interest rates on credit card debt can empower you to tackle your financial challenges more effectively. By employing strategic repayment methods and being informed about your credit, you can take significant steps toward financial freedom.

Exploring the Snowball and Avalanche Methods for Effective Repayment

When tackling credit card debt, choosing the right repayment strategy is crucial. The two most popular methods are the Snowball Method and the Avalanche Method. Each offers unique advantages, depending on your financial situation and psychological inclinations. Let’s dive deeper into both approaches.

The Snowball Method

The Snowball Method focuses on building momentum by paying off your smallest debts first. Here’s how it works:

- List your debts from smallest to largest, irrespective of interest rates.

- Make minimum payments on all debts except the smallest.

- Put any extra money towards the smallest debt until it’s paid off.

- Once the smallest debt is gone, roll that payment amount into the next smallest debt.

This method is highly motivating for many people because eliminating debts quickly can provide a psychological boost. For example, Suzie’s use of this method resulted in her being debt-free five years and five months later, paying $9,378 in interest overall-but only a minor difference in time compared to other methods [1].

The Avalanche Method

In contrast, the Avalanche Method prioritizes debts based on interest rates. Here’s the process:

- List your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Direct any additional funds toward the highest interest debt until it’s cleared.

- Once that debt is paid off, move to the next highest interest rate debt.

While it may take longer to see individual debts paid off, the Avalanche Method typically results in lower total interest paid over time. By focusing on high-interest loans, you save money in the long run, making it a financially savvy choice [2].

Comparison of the Two Methods

Here’s a quick table to illustrate key differences:

| Method | Focus | Motivation | Total Interest Paid |

|---|---|---|---|

| Snowball | Smallest debt first | Quick wins | Higher |

| Avalanche | Highest interest first | Long-term savings | Lower |

Ultimately, the right strategy depends on your personal preferences and financial circumstances. Are you motivated by small victories or do you prefer to save the most on interest? Both strategies can be effective, so choose the one that resonates with you and your financial goals.

Maximizing Budgeting Techniques to Create a Sustainable Payment Plan

To successfully manage and pay off credit card debt, it’s essential to implement effective budgeting techniques that not only help in tracking expenses but also facilitate creating a sustainable payment plan. Here are several strategies to consider:

- Establish a Realistic Budget: Begin by calculating your monthly income and fixed expenses. Include necessities such as rent or mortgage, utilities, groceries, and transportation. This clear picture will allow you to see how much extra money you can allocate toward credit card payments.

- Utilize the Envelope System: This traditional budgeting method involves dividing your cash into different envelopes for various spending categories. Stick to using only the cash in each envelope. This technique can prevent overspending and help manage your monthly outgoings effectively.

- Implement the 50/30/20 Rule: This guideline suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust these percentages based on your specific financial situation to ensure that you are setting aside adequate funds for paying off debt.

- Track Your Expenses: Use budgeting apps like Mint or YNAB (You Need A Budget) to closely monitor where your money goes. Identifying unnecessary expenses can free up additional funds for credit card payments.

- Set Up an Emergency Fund: While it may seem counterintuitive when focusing on debt, establishing a small emergency fund can prevent you from using credit cards for unexpected expenses. Aim for at least $500 as a starting point.

Combining these techniques can lead to a more manageable financial situation. Here’s a simple table to help you visualize how much you can allocate toward your credit card debts each month:

| Monthly Income | Fixed Expenses (50%) | Wants (30%) | Debt Repayment/Savings (20%) |

|---|---|---|---|

| $3,000 | $1,500 | $900 | $600 |

| $4,000 | $2,000 | $1,200 | $800 |

Remember, regular review and necessary adjustments to your budgeting techniques will enhance their effectiveness. Commit to periodic evaluations, ensuring you remain on track toward your goal of becoming debt-free.

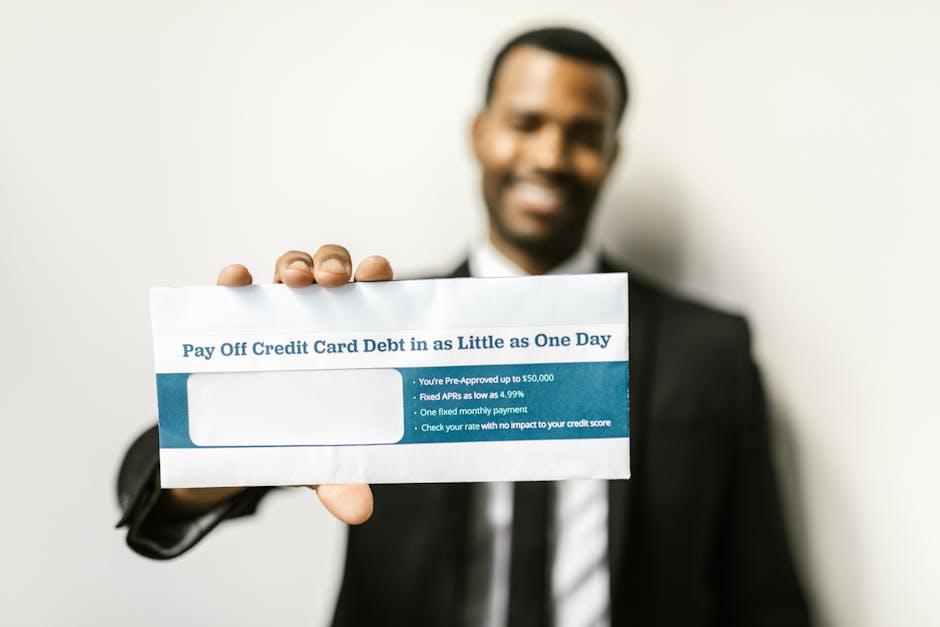

Leveraging Balance Transfers and Negotiation Tactics for Debt Relief

When you find yourself bogged down by credit card debt, leveraging balance transfers and employing negotiation tactics can be powerful strategies to regain control of your finances. Understanding how to utilize these tools effectively can significantly reduce your overall debt burden.

Balance Transfers

A balance transfer involves moving your existing credit card debt to a new credit card that typically offers a lower interest rate or a promotional 0% APR period. This can create significant savings over time and help you pay off your debt faster.

- Choose the Right Card: Look for cards that offer 0% introductory APR on balance transfers for at least 12 to 18 months. Examples include cards from Chase, Discover, and Citi.

- Calculate Transfer Fees: Most balance transfer offers come with a fee (usually 3%-5% of the amount transferred). Ensure that the savings from the lower interest rates exceed these fees.

- Create a Payment Plan: Once the balance is transferred, develop a plan to pay off as much of the balance as possible before the promotional period ends to avoid high-interest charges.

Negotiation Tactics

Negotiating with creditors can also yield favorable terms that ease your debt repayment journey. Here’s how to effectively negotiate:

- Know Your Credit Standing: Check your credit score through sites like Credit Karma or AnnualCreditReport.com. A better understanding of your credit can empower your negotiation.

- Contact Customer Service: Call your credit card issuer. Politely explain your situation and ask for reduced interest rates or a payment plan. Be honest and express your intention to pay off your debts.

- Ask for Hardship Programs: Some banks, such as Bank of America and PNC Bank, offer hardship programs that may provide forbearance or lower payment requirements based on your financial situation.

Benefits of These Strategies

| Strategy | Benefits |

|---|---|

| Balance Transfers | Lower interest rates, potential for zero-interest periods, reduce overall debt. |

| Negotiation Tactics | Customized payment plans, reduced monthly payments, possible interest rate reductions. |

Implementing balance transfers and negotiation tactics effectively can pave the way to financial freedom. By taking proactive steps and being diligent with your payments, you can significantly reduce your credit card debt and improve your financial health.

The Way Forward

In the dynamic realm of personal finance, the journey to freeing yourself from credit card debt doesn’t have to be a solitary or daunting path. Armed with strategic insights and a clear plan, you can transform your financial landscape and reclaim your peace of mind. Whether you opt for methods like the debt snowball or the avalanche strategy, every small step you take today can lead to significant progress tomorrow. Remember, the key lies in consistency and a commitment to better financial habits. As you embark on this journey, keep your goals in sight, and celebrate the victories along the way-no matter how small they may seem. By taking control now, you’re not just reducing debt-you’re paving the way for a brighter, more secure financial future. The time to act is now; take that first step towards financial freedom today.