In the tapestry of parenthood, securing the future of your family often ranks high on the list of priorities. Life insurance emerges as a vital thread in this fabric, offering peace of mind in uncertain times. As parents navigate the joys and challenges of raising children, the question of how to protect their loved ones from unforeseen financial burdens is paramount. This essential guide explores the nuances of life insurance policies tailored for parents in the U.S. From understanding the array of available options to determining the right time to purchase a policy, we delve into the intricacies that empower parents to make informed decisions for their families’ futures. Whether you’re a new parent or looking to reassess your current policy, this comprehensive resource will provide the clarity and insight needed to safeguard your family’s well-being.

Understanding the Basics of Life Insurance: A Parent’s Perspective

When considering life insurance for your parents, it’s essential to grasp the fundamentals specific to their needs and circumstances. Understanding these basics can help you make informed decisions that protect their legacy and provide peace of mind for your family.

Key Factors to Consider

- Consent: Before taking out a policy, it’s crucial to obtain your parents’ consent. They need to be involved in the decision-making process, ensuring transparency and trust.

- Insurable Interest: To buy a life insurance policy for someone else, you must have an insurable interest. This means you would suffer a financial loss if the insured were to pass away.

- Health and Age: Premiums are influenced by the insured’s age and health status. Older adults or those with pre-existing conditions typically face higher rates, so it’s important to assess these factors carefully.

- Policy Type: There are several types of life insurance policies available, such as term life and permanent life. Each comes with distinct benefits and should be matched to your parents’ financial situation and goals.

Types of Life Insurance Policies

| Policy Type | Description | Best For |

|---|---|---|

| Term Life Insurance | Covers a specified period (e.g., 10, 20 years). Offers lower premiums but no cash value. | Temporary coverage needs, like paying off a mortgage or college tuition. |

| Permanent Life Insurance | Provides lifetime coverage with a cash value component that grows over time. | Long-term financial planning and estate considerations. |

Benefits of Life Insurance for Parents

- Financial Security: Helps cover unexpected expenses such as funeral costs, debts, or medical bills, easing the burden on the family during a difficult time.

- Legacy Planning: Ensures that funds are available for future needs, such as college education for grandchildren or significant charitable contributions.

- Peace of Mind: Provides assurance that financial obligations will be met, allowing for a smoother transition for loved ones left behind.

Understanding the basics of life insurance can empower you to make decisions that align with the best interests of your parents and family. Always consult with a trustworthy insurance advisor to choose the best policy for your family’s needs and circumstances.

Evaluating Coverage Needs: How Much Life Insurance is Right for Your Family

When considering how much life insurance you need, it’s essential to take a comprehensive look at your family’s financial situation, future goals, and current obligations. Each family’s needs vary significantly, so understanding your unique circumstances will guide you in selecting the right coverage amount.

Start by evaluating your current financial commitments:

- Mortgage Payments: Calculate any outstanding mortgage balances. Your life insurance should cover these expenses to prevent your family from losing their home.

- Debt Obligations: Include any credit card debts, personal loans, or student loans that may need to be settled.

- Childcare Costs: Factor in future childcare expenses, especially if you have young children. Will your spouse need additional support, or will you need to pay for daycare or preschool?

Next, assess your family’s future needs:

- Education Expenses: Consider the costs of higher education for your children. Whether it’s public college or private school, estimate the total expenses and include that in your coverage calculation.

- Living Expenses: Think about ongoing expenses such as groceries, utilities, and healthcare. A good rule of thumb is to cover 5-10 years of living expenses to provide stability.

- Income Replacement: If you are the primary earner, consider how much salary your family would need to maintain their quality of life. Calculate this based on your current income and how long you want to provide support.

Consider a life insurance calculator: Many insurance providers, such as State Farm and MetLife, offer online tools to help estimate the required coverage. These calculators take into account various factors, including age, income, and dependents, to give you a personalized recommendation.

| Factor | Example Amount |

|---|---|

| Outstanding Mortgage | $200,000 |

| Credit Card Debt | $15,000 |

| Childcare (5 years) | $60,000 |

| Education Fund | $100,000 |

| Living Expenses (5 years) | $300,000 |

| Income Replacement (5 years) | $500,000 |

Review your existing policies: If you already have some life insurance in place, consider its coverage limits. You might need more or less based on significant life changes like the birth of a child, a new home purchase, or changes in employment status.

Lastly, consider consulting a financial advisor or insurance agent to help ensure that you’ve captured all your family’s needs accurately and comprehensively. Having tailored advice can enhance your financial planning process and secure your family’s future effectively.

Exploring Policy Types: Term vs. Whole Life Insurance Explained

When it comes to securing your family’s financial future, understanding the different types of life insurance is crucial. Two of the most common types are term life insurance and whole life insurance. Each offers distinct benefits and can cater to different financial needs and goals.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. This type of policy is designed to give financial protection to your beneficiaries in the event of your passing during the term.

- Affordability: Term policies usually have lower premiums compared to whole life, making them budget-friendly for many families.

- Fixed Coverage: You choose a coverage amount, known as the death benefit, which will be paid to your beneficiaries.

- Temporary Coverage: Ideal for covering specific financial responsibilities such as mortgage payments or children’s education until those obligations are met.

- No Cash Value: Unlike whole life insurance, term policies do not build cash value over time.

- Renewable or Convertible: Many term policies allow you to renew at the end of the term or convert to a whole life policy without a medical exam.

Whole Life Insurance

Whole life insurance is a type of permanent insurance that provides coverage for your entire life, as long as premiums are paid. This policy includes both a death benefit and an investment component.

- Lifetime Coverage: As long as premiums are paid, your beneficiaries are guaranteed a death benefit regardless of when you pass away.

- Cash Value Accumulation: Part of your premium goes toward building cash value, which grows tax-deferred over time.

- Fixed Premiums: Premiums are generally fixed and will not increase over time, providing predictability in budgeting.

- Loan Options: You can borrow against the cash value of the policy, giving you access to funds in emergencies.

- Higher Initial Costs: Whole life premiums are typically higher than term life, reflecting the lifelong coverage and cash value benefits.

Key Differences

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Temporary (10-30 years) | Lifetime |

| Cash Value | No | Yes |

| Premiums | Lower | Higher |

| Flexibility | Limited | More options (loans, dividends) |

Choosing between term and whole life insurance depends on your family’s specific needs, financial situation, and future goals. Evaluating both options ensures you make a decision that best protects your loved ones.

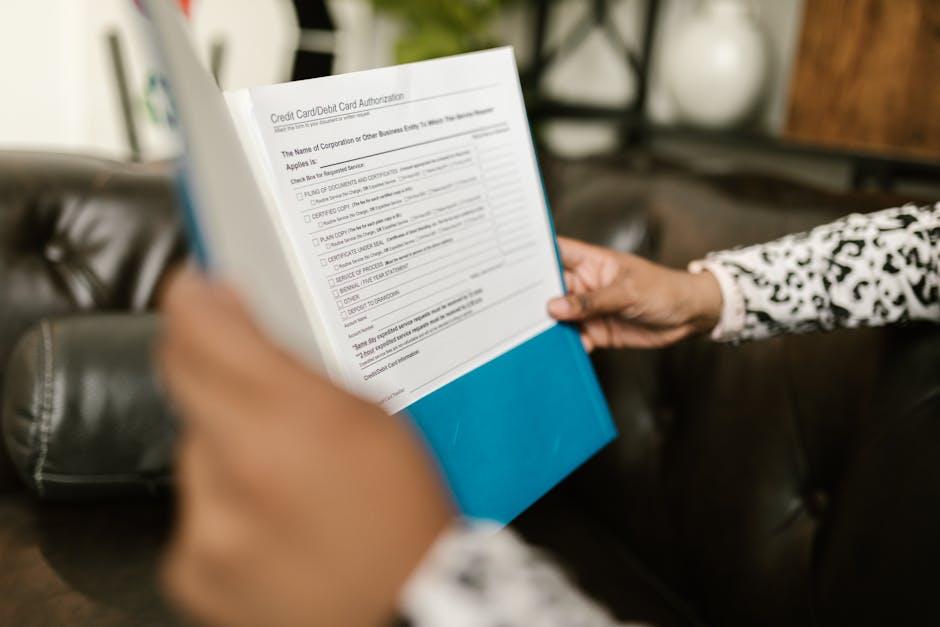

Navigating the Application Process: Tips for Smooth Enrollment and Selection

Navigating the life insurance application process can seem daunting, but with the right approach, it can be a straightforward experience. Here are some tips to help you gain clarity and confidence as you move through enrollment and selection.

- Determine Your Coverage Needs: Start by assessing how much life insurance coverage your family would need. Consider factors such as outstanding debts, future education costs, and daily living expenses.

- Choose the Right Policy: Familiarize yourself with the different types of policies: term life, whole life, and universal life. Each has distinct benefits and drawbacks based on your financial goals and family needs.

- Gather Required Information: Before filling out the application, have necessary documents ready, such as social security numbers, medical history, and financial information, to expedite the process.

- Compare Quotes: Use online tools to obtain multiple quotes from various providers. Websites like Policygenius can help streamline this process, comparing options in one place.

- Consult with an Expert: If you’re feeling overwhelmed, consider consulting a financial advisor or insurance broker. They can provide personalized recommendations tailored to your unique situation.

- Understand the Underwriting Process: Be prepared for potential medical exams and questions during underwriting. This helps insurers assess your health risk, which can affect your premium rates.

To help visualize your options, here’s a simple comparison table of types of policies:

| Policy Type | Coverage Duration | Cash Value | Premiums |

|---|---|---|---|

| Term Life | 10-30 years | No | Generally lower |

| Whole Life | Lifetime | Yes | Higher but predictable |

| Universal Life | Lifetime | Yes, adjustable | Flexible |

During the application process, be honest and thorough when providing information. Any discrepancies or omissions can lead to complications later on, including denied claims. Taking the time to navigate this process thoughtfully ensures that you secure the protection your family needs.

To Wrap It Up

In conclusion, navigating the world of life insurance can be a crucial step for parents looking to secure their family’s financial future. Whether you choose term life insurance for its affordability and simplicity or opt for permanent policies to build long-term value, understanding your options is key. Reflecting on your family’s unique needs and circumstances will guide you in selecting a policy that works best for you. Remember, life insurance is not just a safety net; it’s an investment in peace of mind for you and your loved ones. As you weigh your choices, take the time to consult with trusted financial advisors or agents who can help illuminate the path forward. Embrace this opportunity to protect what matters most and ensure that your family’s future remains bright, no matter what lies ahead.