In an era where financial independence and access to credit are paramount, many individuals find themselves navigating the complexities of credit scores and income requirements. For those with limited credit histories or unconventional income streams, the world of traditional credit cards can feel like a closed door. However, a unique solution is emerging in the form of Fixed Deposit (FD) backed credit cards. These cards provide a pathway to unlocking credit potential without the typical restraints of income verification or robust credit ratings. By leveraging the security of a fixed deposit account, individuals can obtain a credit card that not only enhances their purchasing power but also fosters financial growth. In this article, we will explore how FD-backed credit cards work, their advantages, and why they might be the key to financial empowerment for many.

Exploring the Basics of Fixed Deposit Secured Credit Cards

Fixed deposit secured credit cards offer a unique solution for individuals seeking access to credit without a traditional income source. By leveraging a fixed deposit account as collateral, cardholders can obtain a credit limit that typically corresponds to the funds locked in their deposit. This arrangement not only provides an opportunity to build or improve credit scores but also adds a layer of financial security for both the issuer and the cardholder. With the minimal risk involved, lenders are often more inclined to approve applications from those without regular income.

Understanding the workings of these credit cards is essential for making informed financial decisions. Here are some key points to consider:

- Credit Limit: Usually based on the fixed deposit amount.

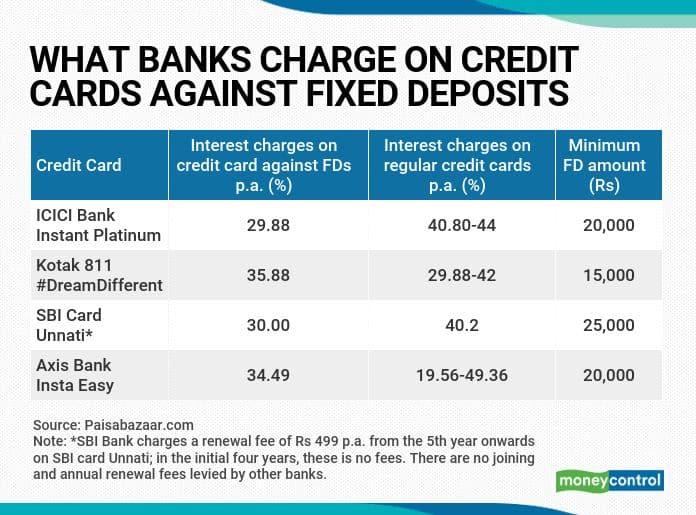

- Interest Rates: Often lower than unsecured credit cards.

- Access to Rewards: Some cards offer cashback or reward points.

- Safety Net: The fixed deposit assures the lender of repayment.

- Eligibility: Easier approval for those without a stable income.

| Feature | Description |

|---|---|

| Collateral | Fixed deposit as security |

| Access to Credit | Immediate, even without income |

| Build Credit | Helps improve credit score |

| Withdrawal Restrictions | Funds are locked in until account closure |

Understanding Eligibility Criteria Without Traditional Income

In the evolving landscape of personal finance, securing a credit card without traditional income sources is increasingly feasible through the use of fixed deposits. Financial institutions often recognize the potential of these deposits as a reliable form of collateral, allowing individuals to maintain a positive credit profile even when they lack regular employment income. This approach entails pledging a fixed deposit as security, which provides assurance to the lender while giving you access to essential credit facilities. As a result, applicants can navigate the tricky waters of creditworthiness with greater confidence.

When considering this option, there are a few key eligibility criteria to keep in mind:

- Fixed Deposit Tenure: The tenure of the fixed deposit may influence your eligibility; longer terms can typically yield better credit terms.

- Deposit Amount: A higher deposit amount often correlates with a higher credit limit.

- Age and Credit History: While traditional income may not apply, your age and existing credit history will be scrutinized.

By understanding these parameters, potential applicants can better navigate their options and successfully unlock credit facilities, enabling them to manage their expenses without compromising their financial integrity.

Maximizing Benefits of Secured Credit Cards for Financial Flexibility

Secured credit cards offer a pathway to financial flexibility, especially for individuals with limited income or a challenging credit history. By using a fixed deposit as collateral, borrowers can effectively maximize the benefits of these cards while building their credit scores. This method allows users to enjoy the advantages of traditional credit cards, such as:

- Building Credit History: Making timely payments can improve your credit score.

- Enhanced Purchasing Power: Even with a limited income, you can make necessary purchases.

- Financial Discipline: Encourages responsible spending habits through the secured deposit mechanism.

When considering a secured credit card, it’s essential to choose one that aligns with your financial goals. Look for cards with low fees, favorable interest rates, and rewards programs. The following table summarizes key features to evaluate:

| Card Feature | Importance |

|---|---|

| Annual Fee | Lower fees mean more savings. |

| Interest Rate | A lower rate helps minimize debt costs. |

| Rewards Program | Earning points can provide additional value. |

Practical Steps to Build Credit History with Fixed Deposits

Building a solid credit history can be achieved through the strategic use of fixed deposits. By placing a fixed amount into a deposit account, you not only earn interest but also create a reliable record of financial responsibility. This can be pivotal for those who might lack a traditional income source. Here are practical steps to leverage fixed deposits in enhancing your credit profile:

- Research Financial Institutions: Choose banks that report to credit bureaus and offer fixed deposit accounts tailored for those with limited income.

- Open a Fixed Deposit Account: Ensure the deposit term is manageable and aligns with your financial timelines.

- Maintain Consistency: Consider keeping the account active for a longer duration to establish stability and reliability.

In addition to establishing a credit footprint, fixed deposits can also aid in accessing secured credit cards. By tying your card limit to your deposit, financial institutions minimize risk while still allowing you to build credit. This can open doors for future credit opportunities. Follow these steps to make the most out of your fixed deposit:

- Choose a Secured Credit Card: Look for options that accept fixed deposits as collateral.

- Utilize the Card Wisely: Make small purchases and pay off the balance promptly to demonstrate creditworthiness.

- Monitor Your Credit Score: Regularly review your credit report to track improvements and rectify any discrepancies.

The Conclusion

In conclusion, unlocking credit cards through fixed deposits offers a viable pathway for the financially conscious, particularly those without a traditional income source. By leveraging your savings, you can step into a world of credit that may have previously felt out of reach. This method not only broadens your financial options but also helps in building a positive credit history, paving the way for future opportunities. As you embark on this journey, remember to weigh your choices carefully, manage your finances responsibly, and harness the potential that comes with a well-structured financial strategy. Your fixed deposit could be the key to a more empowered financial future.