Unlocking Loans with Aadhaar Alone for Hassle-Free Access

In an age where convenience and speed often dictate our financial experiences, the world of loans is undergoing a transformative shift. Gone are the days of complex paperwork and prolonged approval processes that leave borrowers in a state of uncertainty. Enter Aadhaar-a revolutionary biometric identification system that promises to simplify access to financial services. With Aadhaar as a singular key, individuals across India can now unlock a world of loan possibilities with minimal hassle. This article delves into the nuances of securing loans solely through Aadhaar, exploring its advantages, implications, and the potential it holds for millions seeking financial empowerment. Join us as we unravel how this innovative approach is reshaping the lending landscape and making financial inclusion a tangible reality for all.

Exploring the Benefits of Aadhaar-Only Loan Accessibility

In recent years, the landscape of loan accessibility has transformed dramatically with the introduction of Aadhaar-only loans. By linking loans to the Aadhaar card, financial institutions have simplified the application process, allowing individuals to secure funds without extensive documentation. This shift not only enhances efficiency but also caters to a wider audience, enabling those who may not have traditional credit history to access credit. As a result, individuals can enjoy loan approvals in a matter of hours, minimizing the hassle often associated with conventional lending practices.

Moreover, the Aadhaar-only lending model promotes financial inclusion by reaching underserved populations, ensuring that the benefits of financial services are extended to all corners of society. The reduced paperwork translates into significant time and cost savings for both lenders and borrowers. Below is a brief comparison illustrating the advantages of using Aadhaar for loan applications:

| Traditional Loans | Aadhaar-Only Loans |

|---|---|

| Extensive documentation required | Minimal documentation needed |

| Long approval times | Quick approval process |

| Limited access for those without credit history | Open to all, including those without credit |

Understanding the Application Process for Aadhaar-Based Loans

Applying for loans using just your Aadhaar number offers a streamlined process that minimizes the traditional barriers associated with borrowing funds. Start by ensuring that your Aadhaar details are up-to-date and linked to your mobile number to facilitate easy OTP verification during the application process. Required documentation is typically reduced, which enhances your chances of receiving funds promptly. Key points to remember include:

- Aadhaar Verification: Ensure your Aadhaar is active and linked to your mobile number.

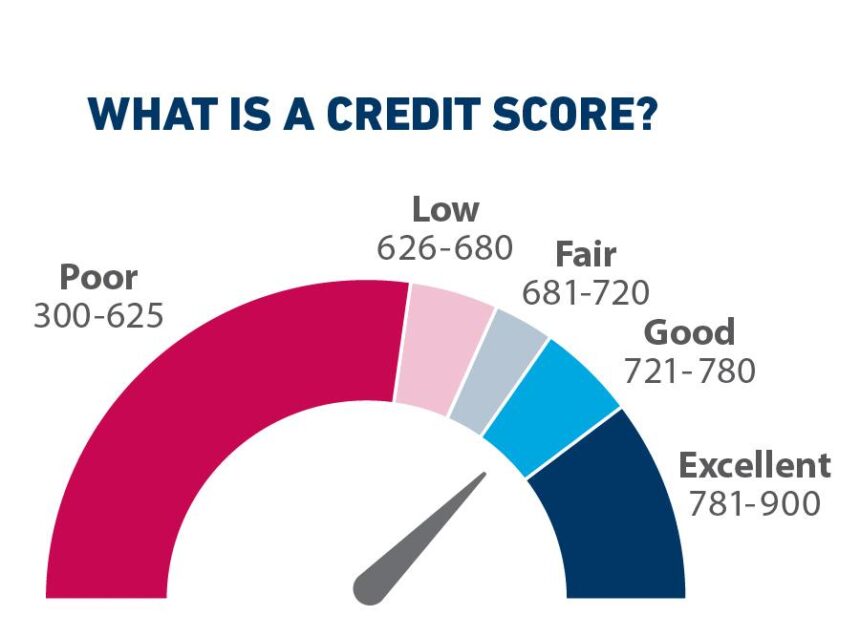

- Creditworthiness: Lenders will assess your credit score, so be aware of your financial history.

- Loan Limits: Understand the maximum loan amount you can apply for based on your profile.

As you navigate the application process, be prepared for quick online submissions, which may include filling out forms on the lender’s website and providing electronic consent for verification. Many lenders utilize advanced technology to personalize offers based on your financial behavior. Here’s a simple comparison of the features of Aadhaar-based loans:

| Feature | Aadhaar-Based Loans | Traditional Loans |

|---|---|---|

| Documentation | Minimal | Extensive |

| Processing Time | Quick | Longer |

| Verification Method | Automated | Manual |

| Accessibility | Online | In-person |

Key Considerations for Borrowers Utilizing Aadhaar Verification

When leveraging Aadhaar verification for loans, borrowers should approach the process with keen awareness. First and foremost, it’s essential to ensure that your Aadhaar details are accurate and up-to-date, as discrepancies can lead to delays or even rejection of applications. Borrowers should also be mindful of their credit score, as this will play a significant role in determining the loan amount and interest rates. Maintaining a balanced budget and understanding your repayment capabilities will help in making informed decisions.

Security is another critical aspect to consider when utilizing Aadhaar for verification purposes. Borrowers are encouraged to be vigilant about safeguarding their personal information against potential fraud. Here are some factors to keep in mind:

- Share Aadhaar only when necessary: Limit sharing your Aadhaar number to trusted entities.

- Utilize the masked Aadhaar option: This allows you to share only the last four digits.

- Regularly monitor financial transactions: Keep a close eye on your bank statements and credit reports.

| Consideration | Description |

|---|---|

| Accuracy | Ensure all details are correct to avoid issues. |

| Credit Score | A good score can improve loan terms. |

| Security | Protect your Aadhaar from unauthorized use. |

Enhancing Financial Literacy for Better Loan Management with Aadhaar

In today’s fast-paced financial landscape, understanding how to manage loans effectively is essential for personal and business growth. Financial literacy plays a crucial role in enabling individuals to make informed decisions regarding loans. The integration of Aadhaar, a unique identification system, streamlines the loan application process by providing lenders with verified identity and credit histories. This not only expedites approval times but also enhances transparency, reducing the chances of fraud. By leveraging Aadhaar, borrowers can gain access to a variety of financial products more efficiently.

To make the most of the advantages that come with Aadhaar, it’s essential to focus on enhancing financial literacy among potential borrowers. This can be achieved through targeted educational programs that highlight key aspects of loan management, such as understanding interest rates, repayment schedules, and the consequences of default. Financial literacy initiatives can equip individuals with the knowledge to:

- Evaluate loan options: Assess different loan products and select the best fit for their needs.

- Understand terms and conditions: Decode complex financial jargon to make informed agreements.

- Budget effectively: Create repayment plans that align with their financial capacity.

Final Thoughts

In conclusion, the integration of Aadhaar for unlocking loans marks a significant step toward simplified and accessible financial solutions. By leveraging this unique identification system, borrowers can enjoy a more streamlined application process, enhance their credibility, and unlock opportunities that were once mired in paperwork and bureaucracy. As financial institutions continue to embrace this innovative approach, the dream of hassle-free access to loans is becoming an increasingly reachable reality. Embracing technology not only empowers individuals but also fosters a more inclusive economy, paving the way for a future where financial freedom is within everyone’s grasp.