In today’s fast-paced digital world, the need for quick financial solutions has never been more pressing. Imagine a scenario where you can unlock ₹50,000 in loans without the hassle of visiting a bank. This convenience is becoming a reality for many, as innovative financial technologies pave the way for instant loans at your fingertips. This article explores how you can navigate the landscape of online lending, the benefits it brings, and crucial tips to ensure a seamless borrowing experience-all from the comfort of your home. Join us as we delve into the future of finance, where accessibility meets simplicity, making instant liquidity an attainable goal for all.

Exploring Instant Loan Solutions in a Digital Era

In today’s fast-paced world, the landscape of personal finance has transformed dramatically, making instant loans more accessible than ever. With just a few taps on your smartphone, you can secure up to ₹50,000 without the hassle of visiting a bank. The rise of digital lending platforms allows you to benefit from streamlined applications, quick approvals, and flexible repayment options. Here are some advantages of opting for instant loans:

- Convenience: Apply from anywhere, anytime.

- Speed: Receive funds in mere hours.

- Simplicity: Minimal documentation required.

Moreover, these digital solutions often employ advanced algorithms to assess your creditworthiness swiftly. This means even those with a less-than-perfect credit history may be eligible for funding. Unlike traditional banks, online lenders offer user-friendly interfaces and 24/7 customer support, ensuring a seamless borrowing experience. Consider the following features when choosing a platform:

| Feature | Benefit |

|---|---|

| Interest Rates | Competitive rates tailored for your profile. |

| Repayment Flexibility | Options that suit your financial situation. |

| Instant Approval | Fast decisions for urgent needs. |

Understanding Eligibility and Application Processes

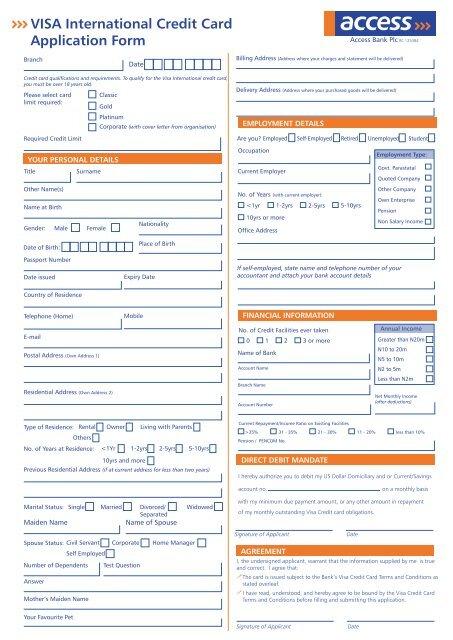

To successfully unlock instant ₹50,000 loans without the hassle of visiting a bank, understanding eligibility requirements is crucial. Generally, you must meet certain criteria to be considered for these loans. The primary factors include:

- Age: Applicants typically need to be at least 18 years old.

- Income: A stable source of income ensures lenders view you as a responsible borrower.

- CIBIL Score: A good credit score can significantly enhance your chances of approval.

- Document Verification: Ensuring all documents, such as identity proof and address proof, are in order can expedite the application process.

Once you confirm your eligibility, the application process is straightforward and can often be completed online. Applicants usually need to fill out a simple form and submit the required documents digitally. The typical steps in the process are:

- Online Form Submission: Fill in personal and financial details.

- Document Upload: Attach relevant identification and income proofs.

- Loan Approval: Await confirmation from the lender, which may be instant or take a few hours.

- Funds Disbursement: Upon approval, the loan amount is transferred directly to your bank account.

Tips for Securing the Best Interest Rates

To secure the most competitive interest rates, it’s essential to maintain a strong financial profile. Start by checking your credit score, as higher scores typically attract better rates. To bolster your score:

- Pay off outstanding debts promptly.

- Keep your credit utilization below 30%.

- Avoid opening multiple new accounts in a short period.

Another effective strategy is to shop around and compare offers from various lenders. Different institutions may have varying eligibility criteria and interest rates. Look for lenders that offer:

- Flexible repayment options

- Low origination fees

- Discounts for automatic payments

Consider using online comparison tools to easily evaluate multiple options side by side. By taking these steps, you can enhance your chances of unlocking the best rates for your instant loans.

Navigating the Fine Print of Loan Agreements

Understanding the intricacies of loan agreements is essential for anyone considering an instant ₹50,000 loan. These documents often contain terms that can significantly impact your financial decision. Key elements to scrutinize include interest rates, repayment terms, and any hidden fees that could affect the total cost of borrowing. Always read through the fine print carefully, as it may reveal:

- Variable interest rates: Which can change based on market conditions.

- Prepayment penalties: Fees for paying off the loan early.

- Loan origination fees: One-time fees charged by lenders for processing your loan.

Additionally, some agreements may include clauses regarding default conditions and credit reporting. It’s crucial to be aware of what actions can trigger a default, as well as how the lender plans to report your payment history to credit bureaus. For a clearer understanding of your obligations and rights, consider creating a simple comparison table of different loan offers, highlighting:

| Lender | Interest Rate | Loan Term | Fees |

|---|---|---|---|

| Lender A | 10% | 12 months | ₹1,000 |

| Lender B | 12% | 12 months | ₹1,500 |

| Lender C | 11% | 6 months | No fees |

Concluding Remarks

Unlocking instant loans of ₹50,000 without the hassle of stepping into a bank can empower you to take control of your financial needs swiftly and conveniently. As you navigate this seamless process, remember to assess your repayment abilities and choose a lender that aligns with your requirements. The digital landscape offers numerous options, making it easier than ever to secure the funds you need for unexpected expenses or fulfilling your dreams. Embrace the freedom and accessibility of modern lending solutions, and step confidently into your financial future.